Master’s programs in financial advising increasingly emphasize ethical considerations. From building trust with clients to navigating complex regulations, ethical conduct is paramount. This comprehensive overview delves into the key ethical principles and regulatory frameworks covered in these programs, highlighting common dilemmas and best practices.

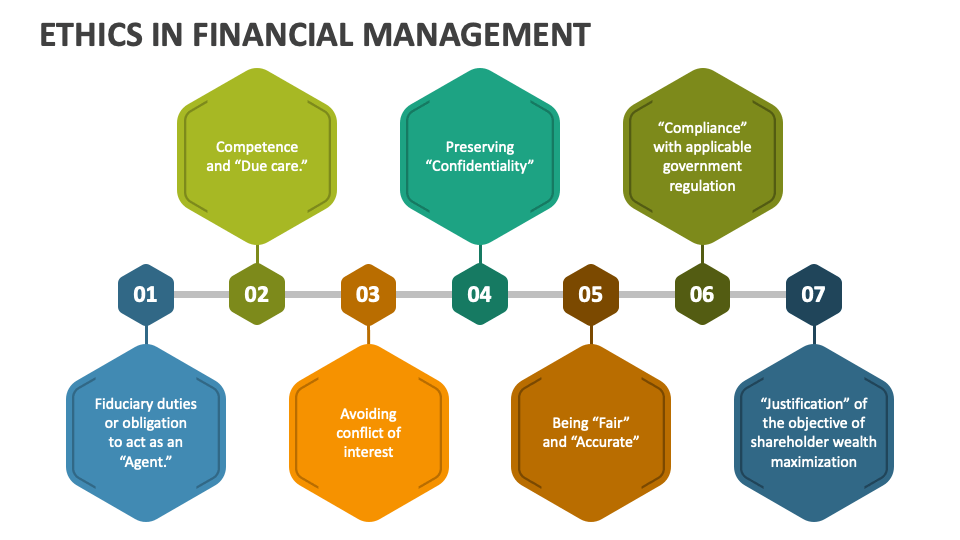

The ethical landscape of financial advising is multifaceted, demanding a deep understanding of confidentiality, conflicts of interest, fiduciary duty, and fairness. Master’s programs equip aspiring advisors with the knowledge and skills to navigate these challenges effectively, fostering a strong foundation for ethical decision-making.

Introduction to Ethical Considerations in Financial Advising

Financial advising, a cornerstone of personal and institutional wealth management, is intrinsically tied to ethical principles. Trust and transparency are paramount in fostering enduring client relationships, ensuring the advisor’s integrity remains uncompromised. A robust regulatory framework exists to uphold these standards, safeguarding both the advisor and the client from potential harm. This section explores the ethical considerations integral to the profession, examining the importance of ethical conduct, the regulatory landscape, and common dilemmas financial advisors face.Ethical conduct in financial advising is not merely a set of rules but a fundamental principle.

Maintaining client trust, ensuring objectivity, and prioritizing client best interests are vital components of building and sustaining successful relationships. A breakdown in these ethical pillars can lead to significant reputational damage and legal repercussions for the advisor, potentially harming the client’s financial well-being.

Remember to click What are the admission requirements for a top-ranked financial advisor master’s program? to understand more comprehensive aspects of the What are the admission requirements for a top-ranked financial advisor master’s program? topic.

Importance of Ethical Conduct in Financial Advising

Ethical conduct is the bedrock of a strong and sustainable financial advising practice. It directly impacts the advisor’s reputation and the client’s trust. A history of ethical decision-making builds long-term client relationships, fostering loyalty and referrals. Conversely, breaches of ethical standards can lead to severe consequences, including disciplinary actions, reputational damage, and legal challenges.

Regulatory Framework Governing Financial Advisors

Numerous regulations and compliance requirements govern financial advisors globally. These frameworks are designed to protect investors and ensure ethical practices are followed. For example, the Securities and Exchange Commission (SEC) in the United States, and equivalent bodies in other jurisdictions, enforce rules on investment recommendations, conflicts of interest disclosure, and client suitability. These regulations establish a minimum standard for ethical behavior and professional conduct.

Failure to comply can result in severe penalties.

Common Ethical Dilemmas Faced by Financial Advisors

Financial advisors frequently encounter situations presenting ethical challenges. These dilemmas often arise from conflicts of interest, client pressures, or evolving market conditions. These situations require a nuanced understanding of ethical principles and regulatory guidelines.

| Ethical Dilemma | Description |

|---|---|

| Confidentiality | Maintaining client information’s privacy while balancing legal obligations to disclose sensitive data. |

| Conflicts of Interest | Simultaneous representation of multiple clients with potentially opposing interests. |

| Client Suitability | Determining if a financial product aligns with a client’s financial situation and objectives. |

| Investment Recommendations | Providing recommendations based on objective analysis rather than personal gain. |

| Fee Structures | Transparency and clarity in fees and commissions to avoid misrepresentation. |

Conflicts of Interest

Financial advisors, entrusted with managing clients’ wealth, face a complex web of potential conflicts of interest. These conflicts, if not properly managed, can erode client trust and lead to significant financial harm. Understanding these conflicts and the strategies to mitigate them is crucial for ethical financial advising.Conflicts of interest in financial advising arise when an advisor’s personal interests or those of their firm could potentially influence their recommendations to clients.

This influence can compromise objectivity and potentially lead to suboptimal financial choices for the client. These situations are not always obvious, requiring advisors and clients alike to be vigilant in their awareness and evaluation.

Types of Conflicts of Interest

Financial advisors can face various conflicts of interest, often stemming from incentives tied to specific products or services. For example, an advisor might receive commissions on specific investments, potentially leading them to recommend those investments over others that may be more suitable for the client’s needs. Other conflicts include undisclosed fees, undisclosed personal investments, and biases based on the advisor’s own financial circumstances.

Potential Impacts on Clients

Conflicts of interest can have detrimental effects on clients. Clients might be steered towards investments that are not aligned with their financial goals or risk tolerance, potentially leading to significant financial losses. Furthermore, a lack of transparency can damage client trust and confidence in the advisor’s integrity. This loss of trust can be difficult to recover and can impact future financial decisions.

Strategies for Identifying and Mitigating Conflicts of Interest

Recognizing and mitigating conflicts of interest requires proactive measures. Financial advisors should meticulously disclose any potential conflicts to clients upfront, outlining the nature of the conflict and its potential impact on the advice provided. This transparency builds trust and allows clients to make informed decisions. A comprehensive disclosure document, outlining potential conflicts, should be readily available and reviewed by the client.

This helps to maintain objectivity in the financial advice.

Commonly Overlooked Conflicts of Interest

Some conflicts of interest can be easily overlooked. For instance, an advisor might have a close personal relationship with a particular investment firm, leading to biased recommendations. Similarly, advisors who receive significant gifts or hospitality from investment firms may feel pressure to recommend their products, potentially to the detriment of their clients. These situations, while potentially subtle, can have a significant impact.

Steps to Resolve Conflicts of Interest

| Step | Action |

|---|---|

| 1. Recognition | Identify potential conflicts of interest. |

| 2. Disclosure | Fully disclose all potential conflicts to the client. |

| 3. Evaluation | Assess the potential impact of the conflict on the client’s best interests. |

| 4. Mitigation | Implement strategies to mitigate the conflict’s impact. |

| 5. Monitoring | Continuously monitor the conflict and its impact. |

| 6. Consultation | Seek advice from legal counsel or regulatory bodies when necessary. |

Fiduciary Duty and Best Interest Standard

Financial advising ethics are increasingly scrutinized, with regulatory bodies pushing for higher standards of care. A key area of focus is the distinction between fiduciary duty and suitability standards, which directly impacts the responsibilities and decision-making processes of financial advisors. Understanding these nuances is critical for both advisors and clients to ensure transparent and ethical financial dealings.

Defining Fiduciary Duty

Fiduciary duty, a cornerstone of financial advising ethics, obligates advisors to act in the best interests of their clients. This encompasses prioritizing client needs over personal gain. Advisors with a fiduciary duty have a legal and ethical obligation to make recommendations that align with the client’s financial goals and circumstances, not their own. This proactive approach ensures that the client’s well-being is paramount in the advice process.

Detailing the Best Interest Standard

The best interest standard, a more recent regulatory development, further clarifies the responsibilities of financial advisors. It mandates that advisors act in the best interest of their clients, considering all relevant factors, including the client’s financial situation, risk tolerance, and investment objectives. This goes beyond simply recommending suitable investments, demanding a comprehensive understanding of the client’s circumstances. A crucial component of this standard is the need for full and transparent disclosure to clients regarding potential conflicts of interest.

Comparing Fiduciary Duty and Suitability Standards

A key difference between fiduciary duty and suitability standards lies in the level of care. Suitability standards, while important, primarily require advisors to recommend investments that are appropriate for a client’s financial situation. They do not demand the same level of proactive client advocacy as a fiduciary duty. Fiduciary duty requires a deeper commitment to acting in the client’s best interest, including considering alternative investment options that might better align with their needs.

Essentially, a fiduciary advisor goes beyond mere suitability, actively seeking the best possible outcome for the client.

Practical Implications for Financial Advisors

The shift toward a best interest standard significantly alters the practical implications for financial advisors. Advisors must now meticulously document their decision-making process, ensuring that every recommendation is grounded in the client’s best interests. This often involves detailed conversations about client goals, risk tolerance, and financial situation. Implementing robust due diligence processes to assess potential conflicts of interest and disclosing them transparently to clients is also crucial.

These changes necessitate significant changes in the advisor-client relationship, demanding increased transparency and client-centricity.

Illustrative Comparison Table

| Factor | Fiduciary Duty | Best Interest Standard |

|---|---|---|

| Client’s Interests | Primary focus; advisor prioritizes client well-being over personal gain. | Central consideration; advisor must act in client’s best interest, considering all relevant factors. |

| Disclosure | Comprehensive disclosure of potential conflicts of interest is paramount. | Full and transparent disclosure of potential conflicts of interest is mandated. |

| Decision-Making | Proactive approach to identify and recommend the best possible options for the client. | Proactive approach, considering all relevant factors and making recommendations aligned with the client’s best interest. |

| Suitability | Implied but not the sole focus; must consider a wider range of factors beyond suitability. | Must consider suitability but goes beyond it, focusing on the client’s best interest. |

Fairness and Objectivity

Maintaining fairness and objectivity is paramount in financial advising. Clients rely on advisors to provide unbiased recommendations tailored to their specific needs and circumstances, not influenced by personal biases or external pressures. A lack of impartiality can erode trust and lead to poor investment decisions, ultimately harming the client’s financial well-being. This section delves into the critical importance of unbiased advice and the strategies employed to achieve it.

Ensuring Unbiased Advice

Financial advisors must meticulously avoid conflicts of interest that could compromise objectivity. This includes disclosing any potential conflicts to clients upfront and managing them transparently. Adherence to professional codes of conduct and ethical guidelines is crucial in upholding impartiality. By prioritizing client needs over personal gain, advisors can foster trust and build long-term relationships.

Examples of Bias in Financial Advice

Bias can manifest in various ways. An advisor might subtly steer a client towards investments favored by the advisor’s firm, even if those investments aren’t the best fit for the client’s risk tolerance or financial goals. Favoritism toward certain investment strategies or products, influenced by personal connections or compensation structures, can also skew recommendations. Similarly, an advisor might undervalue alternative investment options due to a lack of familiarity or understanding, leading to suboptimal outcomes for the client.

Methods for Maintaining Objectivity

Several methods can help advisors maintain objectivity in their recommendations. Diversifying investment portfolios to minimize reliance on a single product or strategy is one effective method. Employing rigorous due diligence and fact-based analysis, rather than relying on gut feelings or personal preferences, is another key strategy. Regularly seeking second opinions and consulting with other financial professionals can offer valuable perspectives and help ensure well-rounded advice.

Recognizing and Overcoming Personal Biases

Advisors should actively seek to recognize and overcome their personal biases. This involves self-reflection, acknowledging potential blind spots, and actively challenging their own assumptions. Seeking feedback from colleagues or mentors can provide valuable insights and help identify areas for improvement. Continuously educating themselves on market trends, investment strategies, and evolving financial regulations is essential for maintaining objectivity.

The use of objective decision-making frameworks can further help advisors remain unbiased.

Table of Strategies for Fairness and Objectivity

| Strategy | Description |

|---|---|

| Diversification | Spreading investments across various asset classes and avoiding concentration in specific areas. |

| Due Diligence | Thorough research and analysis of investment opportunities, independent of personal preferences. |

| Second Opinions | Seeking input from other qualified professionals to validate recommendations. |

| Continuous Learning | Staying updated on market trends, investment strategies, and financial regulations. |

| Conflict Disclosure | Openly disclosing any potential conflicts of interest to clients. |

Financial Conflicts and Client Education

Financial advisors face a complex landscape where potential conflicts of interest can significantly impact client education. These conflicts, ranging from hidden commissions to investment strategies benefiting the advisor more than the client, demand meticulous transparency and clear communication. Addressing these conflicts head-on and educating clients effectively is crucial for building trust and maintaining ethical standards.

Challenges Posed by Financial Conflicts in Client Education

Financial conflicts, whether perceived or real, create substantial obstacles in educating clients effectively. Clients may distrust information presented by advisors, perceiving it as biased toward the advisor’s financial gain. This distrust can erode the advisor-client relationship, hindering the ability to explain complex financial concepts and investment strategies effectively. Furthermore, advisors may face pressure to prioritize investments with higher commissions, potentially leading to suboptimal recommendations for clients.

Importance of Clear Communication and Transparency in Financial Advising

Open and honest communication is paramount in financial advising. Transparency about potential conflicts of interest and their impact on recommendations fosters trust and empowers clients to make informed decisions. Advisors must clearly articulate how their compensation structures may influence investment strategies. A transparent approach allows clients to assess the objectivity of the advice and the advisor’s motivations.

This, in turn, promotes a more collaborative and ethical relationship.

Examples of Communicating Complex Financial Concepts to Clients

Effectively conveying complex financial concepts requires a client-centric approach. Instead of technical jargon, advisors should use simple, relatable language and visual aids. For instance, explaining diversification can be done by comparing the risk of a single investment to a portfolio of different assets. Analogies, real-world examples, and case studies are powerful tools for simplifying intricate concepts. Presenting information in multiple formats—written materials, presentations, or even interactive online tools—enhances comprehension and engagement.

Methods of Educating Clients about Ethical Considerations

Educating clients about ethical considerations in financial advising goes beyond simply disclosing conflicts of interest. Advisors should actively promote a culture of ethical conduct, making it a central element of their practice. Regular workshops, seminars, or online resources can provide clients with a deeper understanding of ethical principles and best practices. Interactive discussions, case studies, and role-playing exercises can further reinforce the importance of ethical decision-making in financial matters.

Table Outlining Different Client Education Approaches for Various Financial Products

| Financial Product | Education Approach | Specific Examples |

|---|---|---|

| Mutual Funds | Comparative analysis of different fund performance and expense ratios, explaining the role of fund managers and potential conflicts of interest | Use charts to illustrate past performance and risk profiles of various funds. Highlight the impact of different expense ratios on returns. |

| Individual Retirement Accounts (IRAs) | Explanation of different IRA types, tax implications, and potential investment options, emphasizing the importance of diversification | Provide examples of how different investment strategies within an IRA can affect long-term growth and tax liabilities. Emphasize the role of long-term financial planning. |

| Annuities | Comparison of different annuity types, outlining potential fees, commissions, and the impact on client returns | Clearly illustrate the different structures and fees associated with each type of annuity. Present examples of how these fees can affect the overall return. |

Regulation and Compliance

Financial advisors operate within a complex web of regulations designed to safeguard client interests and maintain market integrity. These regulations, enforced by various governmental bodies, are crucial in upholding ethical standards and preventing fraudulent activities. Understanding and adhering to these regulations is paramount for advisors to build trust and maintain a professional reputation.

The Role of Regulatory Bodies

Regulatory bodies play a critical role in overseeing the financial advisory industry. They establish and enforce ethical standards, ensuring advisors act in the best interests of their clients. These bodies scrutinize advisor conduct, investigate complaints, and impose sanctions for violations. Examples include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the UK, and similar organizations globally.

Their actions directly impact the quality of financial advice available to investors.

Penalties for Ethical Violations

Violations of ethical codes and regulations can result in significant penalties. These can range from fines to suspension or revocation of licenses, impacting the advisor’s ability to practice. The severity of penalties often depends on the nature and extent of the violation. For instance, fraudulent activities or blatant disregard for client best interests often result in severe sanctions, deterring similar behavior in the future.

Importance of Staying Updated on Regulatory Changes

The financial regulatory landscape is constantly evolving. New regulations and amendments frequently emerge, addressing emerging risks and market trends. Staying abreast of these changes is vital for advisors to maintain compliance. This requires continuous learning and adaptation to the evolving regulatory environment. Failure to adapt can lead to costly errors and potential legal issues.

Key Regulatory Requirements in Master’s Programs

Master’s programs in financial advising emphasize the significance of regulatory compliance. Key topics covered often include securities laws, investment regulations, and ethical codes of conduct. Students learn to navigate complex regulations, analyze potential conflicts of interest, and develop strategies for maintaining compliance. This education is critical in equipping aspiring advisors with the knowledge and skills needed to operate ethically and responsibly.

Table of Relevant Regulations and Implications

| Regulation | Implications for Financial Advisors |

|---|---|

| Securities Act of 1933 (US) | Requires full and fair disclosure of material information in securities offerings, protecting investors from misleading or incomplete information. Advisors must ensure clients have access to accurate and complete information. |

| Securities Exchange Act of 1934 (US) | Governs trading activities and market conduct. Advisors must understand and comply with reporting requirements, insider trading regulations, and market manipulation prohibitions. |

| Investment Advisers Act of 1940 (US) | Defines the standards for investment advisors and mandates specific registration and disclosure requirements. Advisors must understand and comply with fiduciary duties and best interest standards. |

| Financial Conduct Authority (FCA) regulations (UK) | Artikels specific rules and guidelines for financial advisors operating in the UK, focusing on consumer protection and market integrity. Adherence to principles of fairness, objectivity, and transparency is paramount. |

Case Studies in Ethical Dilemmas

Master’s programs in financial advising increasingly emphasize ethical considerations, recognizing the critical role of integrity in the profession. Ethical dilemmas, however, are not theoretical exercises but real-world challenges that financial advisors face regularly. These scenarios demand a deep understanding of ethical frameworks and a commitment to acting in the best interests of clients.Ethical dilemmas in financial advising often arise from conflicting priorities, such as maximizing returns for clients while adhering to fiduciary duty and maintaining objectivity.

The complexities of the financial market, coupled with evolving regulations, only exacerbate these challenges. The ability to navigate these situations with integrity is paramount for building trust and maintaining the reputation of the financial advisory profession.

A Case Study: The Conflicted Investment

A financial advisor, Sarah, is managing the portfolio of a client, Mr. Smith, a retired teacher with a substantial investment portfolio. Mr. Smith, having worked in education, is particularly interested in socially responsible investments. Sarah, however, has a strong personal investment in a rapidly growing tech company that aligns with her own financial goals.

This tech company is now presenting an attractive investment opportunity for Mr. Smith’s portfolio. The advisor is aware that recommending this investment would generate a substantial commission for her.

Potential Solutions and Outcomes

The ethical dilemma arises from the conflict between Sarah’s personal financial interests and her fiduciary duty to Mr. Smith. Several solutions are possible:

- Full Disclosure and Transparency: Sarah could disclose her personal investment in the tech company to Mr. Smith, highlighting the potential conflict of interest. She could then seek Mr. Smith’s informed consent to proceed with the recommendation, outlining the potential benefits and risks associated with the investment. The outcome would depend on Mr.

Smith’s understanding of the situation and willingness to accept the risk, given the conflict of interest.

- Seeking External Review: Sarah could seek advice from an independent financial advisor or a third-party investment consultant. This external review could help provide an objective assessment of the investment opportunity, mitigating the potential conflict of interest and allowing Sarah to make a recommendation with greater confidence in its suitability for Mr. Smith. The outcome could strengthen Sarah’s professional reputation and ensure Mr.

Smith receives unbiased advice.

- Alternative Investment Strategies: Sarah could explore alternative investment strategies that align with Mr. Smith’s social responsibility goals without involving the tech company. This could potentially address the conflict of interest and maintain the integrity of the relationship. This option could maintain the client relationship but may result in a reduced commission for the advisor.

Hypothetical Case Studies

These case studies illustrate varying ethical challenges:

- Case 1: Pressure from a High-Net-Worth Client: A high-net-worth client pressures a financial advisor to structure an investment strategy that circumvents regulatory requirements, presenting a clear conflict of interest. The outcome hinges on the advisor’s ability to remain steadfast in their ethical obligations, potentially leading to the loss of the client.

- Case 2: Client’s Financial Misconduct: An advisor discovers evidence of their client’s tax evasion, potentially exposing the advisor to legal risks. The ethical challenge lies in deciding whether to disclose the misconduct, considering the potential impact on the client relationship and personal risk to the advisor.

- Case 3: Investment Misrepresentation: A financial advisor, under pressure to meet sales targets, misrepresents an investment’s potential returns to a client. The outcome could lead to legal repercussions and damage the advisor’s reputation.

Applying Ethical Frameworks

Ethical frameworks, such as the utilitarian approach, deontological approach, and virtue ethics, can be applied to resolve these scenarios. Each framework offers a different lens through which to analyze the ethical implications of a given situation, guiding the advisor towards a course of action that prioritizes ethical principles.

Table: Approaches to Resolving Ethical Dilemmas

| Approach | Description | Potential Outcomes |

|---|---|---|

| Full Disclosure | Openly communicate potential conflicts of interest. | Builds trust, maintains transparency, but could lead to client loss. |

| Independent Review | Seek external expertise to evaluate investment. | Mitigates bias, strengthens objectivity, but may incur costs. |

| Alternative Strategies | Explore investment options that avoid conflicts. | Maintains client alignment, potentially reduces commission. |

Final Thoughts

In conclusion, ethical considerations are integral to financial advising, demanding a thorough understanding of confidentiality, conflicts of interest, fiduciary duty, fairness, and regulatory compliance. Master’s programs equip future advisors with the knowledge to address these complex issues, ultimately contributing to a more trustworthy and responsible financial services industry. The robust frameworks and case studies incorporated in these programs underscore the critical importance of ethics in financial advising.