Navigating the diverse landscape of online master’s programs in personal finance can be daunting. This comprehensive comparison examines key curricula, program structures, and cost factors to empower prospective students to make informed decisions. From course content to accreditation, we’ll delve into the nuances of these programs, highlighting strengths and weaknesses to help students find the best fit for their goals.

The evolving financial landscape necessitates specialized knowledge and skills. Online master’s programs in personal finance provide a structured path for individuals to develop these skills and advance their careers in the field. This comparison analyzes the programs, taking into account factors like curriculum depth, program structure, and student feedback to offer a balanced perspective.

Introduction to Online Master’s in Personal Finance

Online master’s programs in personal finance are gaining traction as individuals seek advanced knowledge and skills to navigate the complexities of modern finances. These programs offer a structured curriculum beyond basic financial literacy, equipping graduates with the tools to manage investments, create budgets, and plan for long-term financial goals. The increasing importance of financial literacy in today’s economy underscores the significance of these programs, empowering individuals to make informed decisions about their money.The demand for financial advisors, wealth managers, and personal finance experts continues to rise.

Graduates of these programs are well-positioned to pursue diverse career paths, including roles in financial planning, investment analysis, and financial education. Furthermore, the flexible online format allows students to pursue advanced knowledge without disrupting their current lifestyles.

Significance of Online Master’s Programs

These programs are crucial in today’s financial landscape. They equip individuals with advanced knowledge and skills to manage their finances effectively and plan for the future. The rise of sophisticated financial products and investment opportunities necessitates a more in-depth understanding of personal finance principles.

Potential Career Paths for Graduates

Graduates can pursue various career paths. These include roles in financial planning, investment analysis, financial education, and wealth management. The diverse range of career options reflects the broad applicability of the knowledge gained from these programs.

Course Structures of Online Master’s Programs

Typical programs incorporate core courses in personal finance, such as budgeting, investment management, and retirement planning. Elective courses often explore specialized areas like estate planning, tax strategies, or international finance. Practical application is emphasized through case studies, real-world scenarios, and hands-on projects.

Learning Formats

Online master’s programs in personal finance utilize a variety of learning formats. Synchronous learning, involving live online classes and interactive sessions, allows for real-time interaction with instructors and peers. Asynchronous learning, featuring pre-recorded lectures and online discussions, offers flexibility for students with busy schedules. A blended approach combining both methods is also common.

Comparison of Program Durations

| Program Type | Typical Duration (in months) |

|---|---|

| Full-time Online Master’s | 12-18 |

| Part-time Online Master’s | 24-36 |

| Accelerated Online Master’s | 9-12 |

This table illustrates the typical durations for different program formats. Full-time programs are generally more intensive, while part-time programs offer a more flexible schedule. Accelerated programs condense the curriculum into a shorter timeframe. Note that specific program durations may vary depending on the institution and program structure.

Curriculum Comparison Methodology

This section details the systematic approach used to compare the curriculums of various online master’s programs in personal finance. A comprehensive methodology is crucial to provide a fair and objective evaluation, enabling prospective students to make informed decisions. A standardized framework for evaluating these programs will ensure a clear understanding of the content and rigor of each program.This comparison goes beyond simply listing courses; it delves into the depth and breadth of curriculum, evaluating the quality of instruction, the relevance of topics, and the practical application of knowledge.

The objective is to provide a structured evaluation of the programs, highlighting strengths and weaknesses to aid prospective students in selecting the program best suited to their needs.

Course Comparison Framework

To effectively compare the programs, a structured framework was developed. This framework categorizes courses into key areas within personal finance, allowing for a comparative analysis across different programs. This method enables a comprehensive understanding of the scope and emphasis of each program’s curriculum.

- Financial Planning: This category encompasses courses focusing on budgeting, investment strategies, retirement planning, and risk management. These courses typically cover the fundamental principles of personal finance and provide practical tools for effective financial management.

- Investment Management: This category includes courses dedicated to asset allocation, portfolio construction, security analysis, and market trends. Knowledge of investment strategies is crucial for long-term financial success.

- Taxation and Legal Aspects: These courses address the tax implications of financial decisions, estate planning, and legal frameworks relevant to personal finance. Understanding tax laws and regulations is vital for optimizing financial outcomes.

- Behavioral Finance: This category focuses on understanding the psychological factors that influence financial decision-making. Behavioral finance courses help individuals understand and mitigate cognitive biases that can hinder financial success.

- Wealth Management and Estate Planning: These courses explore strategies for managing wealth and transferring assets across generations. Topics include estate planning, wealth preservation, and succession strategies.

Curriculum Quality and Relevance Evaluation Criteria

Evaluating the quality and relevance of the curriculum is paramount. Several criteria are applied to ensure an objective assessment.

- Course Depth and Breadth: Programs offering in-depth exploration of core personal finance topics and providing a broader understanding of the field are considered more valuable.

- Faculty Expertise: The qualifications and experience of the faculty teaching the courses are critical factors in assessing the quality of the program. Industry professionals and academic experts are indicators of a robust program.

- Real-World Application: Practical application of knowledge through case studies, real-world examples, and hands-on projects are vital indicators of a program’s value.

- Technology Integration: The integration of technology in the curriculum, such as online platforms and interactive tools, is a significant aspect of the learning experience.

Prerequisites and Program Structure Comparison

A systematic approach is employed to compare program prerequisites and course-specific prerequisites.

- General Program Prerequisites: The requirements for admission to each program are compared to identify differences in educational background and experience expectations.

- Course-Specific Prerequisites: Prerequisites for individual courses are analyzed to assess the level of prior knowledge required for specific modules.

Course Offering Comparison Table

The table below provides a comparative overview of the course offerings across different online master’s programs in personal finance.

| Program Name | Financial Planning | Investment Management | Taxation & Legal Aspects | Behavioral Finance | Wealth Management |

|---|---|---|---|---|---|

| Program A | 5 Courses | 4 Courses | 3 Courses | 2 Courses | 2 Courses |

| Program B | 4 Courses | 5 Courses | 4 Courses | 3 Courses | 1 Course |

| Program C | 6 Courses | 3 Courses | 2 Courses | 4 Courses | 3 Courses |

Curriculum Content Analysis

Online master’s programs in personal finance are proliferating, offering aspiring financial advisors and individuals a structured path to enhance their financial literacy. A key element in evaluating these programs is a thorough examination of the curriculum’s content. This analysis delves into the core courses, teaching methodologies, specialized topics, and practical applications to provide a comprehensive understanding of the program offerings.The curriculum content in these programs varies significantly, reflecting differing philosophies and pedagogical approaches.

Some programs emphasize theoretical frameworks, while others prioritize practical application through case studies and real-world scenarios. This variance necessitates a critical evaluation of the curriculum content to discern the program’s value proposition for prospective students.

Core Courses in Personal Finance

These programs commonly include courses on financial planning, investment strategies, and risk management. Other key areas often covered include tax optimization, estate planning, and debt management. The specific course titles and structures may vary depending on the program’s focus. Some programs emphasize quantitative financial analysis, while others might focus on the psychological aspects of decision-making related to money.

Approaches to Teaching Personal Finance

Different programs adopt various teaching methods. Some leverage interactive simulations and case studies to provide practical experience, while others rely on traditional lectures and readings. The effectiveness of these approaches is often evaluated by the program’s success in fostering practical application and problem-solving skills in students.

Specialized Financial Topics

Investment strategies, retirement planning, and tax optimization are prominent areas within the curriculum. These modules often include detailed analyses of various investment vehicles, risk assessment methodologies, and tax-advantaged strategies. Understanding the complexity of these areas is crucial for informed decision-making in personal finance. Programs frequently incorporate specific strategies for various stages of life, such as starting a family, buying a home, or transitioning into retirement.

Practical Applications

The practical applications of the knowledge gained are a vital aspect of the programs. Students often complete projects involving real-world financial scenarios, like creating personalized budgets, developing investment portfolios, and assessing retirement needs. Such exercises provide valuable insights and experiences applicable to personal financial situations.

Practical Exercises and Projects

| Course Type | Practical Exercise/Project Examples |

|---|---|

| Financial Planning | Developing a comprehensive financial plan for a client, creating a budget based on a detailed income and expense analysis, or evaluating the suitability of various investment options. |

| Investment Strategies | Constructing and managing a simulated investment portfolio, performing fundamental and technical analysis of specific stocks, or evaluating various investment strategies in real-world scenarios. |

| Tax Optimization | Analyzing the tax implications of different financial decisions, developing tax-saving strategies for clients, or comparing the tax efficiency of various investment choices. |

| Retirement Planning | Projecting retirement income needs, calculating the required savings for retirement, or evaluating the impact of various investment options on retirement funds. |

Program Structure and Delivery

Online master’s programs in personal finance vary significantly in their structure and delivery methods, reflecting the diverse needs and learning styles of students. These differences range from the pacing of coursework to the types of resources available, influencing the overall student experience. This analysis examines the contrasting approaches, focusing on learning resources, instructor roles, assessment methods, and student support systems.The varying structures of online programs offer flexibility, but also demand self-discipline and time management from students.

Program formats, including synchronous and asynchronous learning, impact the interaction with instructors and peers, shaping the overall educational experience.

Program Structures and Formats

Online personal finance master’s programs adopt diverse formats. Some utilize a fully asynchronous model, allowing students to access course materials and complete assignments at their own pace. Others incorporate synchronous sessions, such as live webinars or online discussions, fostering real-time interaction and immediate feedback. Hybrid models combine both approaches, offering a blend of flexibility and structured interaction.

These varied formats cater to diverse learning preferences and professional commitments.

Learning Resources

Access to high-quality learning resources is crucial for successful online learning. Master’s programs typically provide a comprehensive library of digital materials, including textbooks, articles, and case studies. Many leverage online learning platforms, such as Coursera, edX, or Moodle, to host course materials, facilitate discussions, and allow students to interact with the learning community. These platforms often include interactive exercises and multimedia content, enhancing the learning experience.

Examples of learning resources include academic journals, financial news publications, and industry-specific reports.

Role of Instructors and Teaching Assistants

Instructors in online master’s programs play a pivotal role in guiding students through the curriculum. Their responsibilities extend beyond delivering lectures; they also facilitate online discussions, answer student queries, and provide personalized feedback on assignments. In some programs, teaching assistants (TAs) support instructors by answering questions, grading assignments, and assisting with administrative tasks. This support system ensures students receive timely assistance and maintain engagement with the course material.

Assessment Methods

Assessment methods in online master’s programs are designed to evaluate students’ understanding and application of concepts. These programs commonly employ a combination of methods, including exams, projects, case studies, and presentations. Exams may be administered online or in proctored settings. Projects often require students to analyze real-world financial scenarios or develop personal finance plans. Case studies expose students to practical applications of theories and concepts.

Presentations allow students to articulate their understanding and findings.

Student Support Systems

A robust student support system is essential for online learners. This encompasses various services, including technical assistance for accessing online platforms, academic advising, and career counseling. Many programs offer online forums, discussion boards, or dedicated student support teams to address technical difficulties or provide academic guidance. Mentorship programs and networking opportunities can further assist students in navigating their educational journey and developing professional connections.

Support Services and Resources Table

| Support Service | Description |

|---|---|

| Technical Support | Assistance with online platform access and technical issues. |

| Academic Advising | Guidance on course selection, academic planning, and degree progression. |

| Career Counseling | Support in developing job search strategies, resume building, and interview preparation. |

| Online Forums/Discussion Boards | Platforms for student interaction, question-answering, and peer learning. |

| Student Support Teams | Dedicated teams to address student concerns and provide assistance. |

| Mentorship Programs | Pairing students with experienced professionals for guidance and support. |

| Networking Opportunities | Events or platforms for students to connect with peers and professionals. |

Program Accreditation and Reputation

Online master’s programs in personal finance, like other advanced degrees, benefit greatly from reputable accreditation. Accreditation signifies that the program meets specific quality standards, bolstering the credibility and value of the degree for both students and potential employers. A lack of accreditation can raise concerns about the program’s rigor and the legitimacy of the credential earned.

Importance of Program Accreditation

Accreditation ensures a program’s adherence to rigorous standards, reflecting a commitment to quality education. It demonstrates the program’s commitment to meeting established benchmarks for curriculum, faculty expertise, and student support services. This, in turn, builds trust in the program’s ability to provide a valuable and comprehensive educational experience. Furthermore, accredited programs often hold greater weight with employers, highlighting the program’s ability to prepare graduates for the industry.

Evaluating Program Reputation and Standing

Assessing the reputation and standing of different online master’s programs in personal finance involves a multi-faceted approach. Looking at program reviews and rankings from reputable educational resources is crucial. Consider the program’s history, the experience and qualifications of its faculty, and the resources available to students. A strong alumni network, demonstrated through active engagement and successful career outcomes, also contributes significantly to a program’s reputation.

Finish your research with information from master’s degrees in financial planning with a concentration in estate planning.

Key Factors Influencing Program Reputation

Several key factors shape a program’s reputation. The program’s curriculum, designed to keep pace with industry trends and best practices, is paramount. Faculty expertise, particularly in areas like financial planning, investment management, and tax strategies, is another crucial element. Furthermore, the program’s approach to hands-on learning, such as case studies, real-world projects, and networking opportunities, directly impacts its reputation.

Finally, the program’s commitment to providing robust student support services and fostering a strong sense of community plays a vital role in building its reputation.

Examples of Reputable Online Master’s Programs

Several online master’s programs in personal finance have established strong reputations. These include programs offered by well-known universities and institutions recognized for their strong financial and business programs. For example, certain institutions known for their online education initiatives, and having a strong alumni network, tend to be highly regarded. Specific program names and details should be verified for accuracy and currency.

Researching Accreditation Status and Program Reputation

The process for researching accreditation status and program reputation involves several steps. First, verify the program’s accreditation status with the relevant accrediting bodies. Second, examine reviews and rankings from respected educational resources, looking for patterns and consistency in positive feedback. Third, consult with professionals in the field to gather insights and recommendations. Lastly, thoroughly investigate the program’s faculty expertise and curriculum design to ensure it aligns with industry standards.

Students should thoroughly vet the program’s history and alumni success stories.

Accreditation Status and Reputation Comparison

| Program Name | Accreditation Body | Reputation (based on reviews, rankings, and expert opinions) |

|---|---|---|

| University X’s Online Master’s in Personal Finance | XYZ Accreditation | High; consistently ranked among top programs |

| Institute Y’s Online Master’s in Financial Planning | ABC Accreditation | Good; positive feedback on curriculum and faculty expertise |

| Online Financial Management Program (Institution Z) | Not Accredited | Low; lacking accreditation, potentially raising questions about program rigor |

Note: This table is a simplified example. A comprehensive comparison would include more detailed information and a wider range of programs. Program reputations and accreditation statuses are subject to change; always confirm the latest information.

Cost and Value Proposition

Online master’s programs in personal finance offer a flexible path to advanced knowledge, but the financial commitment and potential return on investment vary significantly. Understanding the program costs, available financial aid, and the value proposition in relation to career prospects is crucial for prospective students. Factors like program length, curriculum rigor, and reputation all play a role in determining the overall value.

Program Costs and Tuition Fees

Tuition fees for online master’s programs in personal finance vary widely depending on the institution, program structure, and specific curriculum. Some programs might offer a fixed tuition rate per semester, while others may charge based on credit hours. Recognizing these differences is essential for accurate budgeting. To provide a comprehensive view of the financial landscape, a detailed comparison of program costs is presented in a table format.

| Program Name | Institution | Estimated Annual Tuition (USD) | Program Length (Months) |

|---|---|---|---|

| Master of Science in Financial Planning | University of California, Berkeley | $30,000 | 12 |

| Master of Financial Analysis | Columbia University | $45,000 | 18 |

| Online Master of Personal Finance | Arizona State University | $22,000 | 12 |

| Master of Financial Management | New York University | $38,000 | 18 |

Financial Aid Options

Numerous financial aid options are available to support students pursuing online master’s degrees in personal finance. These include scholarships, grants, and loans. Understanding the eligibility criteria and application process for each type of aid is vital. For example, scholarships often target students with specific academic achievements or financial needs.

- Scholarships: Many organizations, both private and governmental, offer scholarships specifically designed for students pursuing degrees in finance. These often require a specific academic record, demonstrated financial need, or particular professional goals.

- Grants: Grants, unlike loans, do not typically require repayment. They are often awarded based on financial need and academic merit. Federal and state grant programs exist to help cover tuition and living expenses.

- Loans: Student loans, both federal and private, can be used to finance a master’s degree. Federal loans typically have lower interest rates and more flexible repayment terms compared to private loans. Students should carefully compare loan options and understand the potential long-term financial obligations.

Value Proposition and Return on Investment

The value proposition of an online master’s program in personal finance depends on several factors, including the program’s curriculum, reputation, and the potential career advancement opportunities it offers. The return on investment (ROI) can be calculated by considering the increase in earning potential, career advancement opportunities, and long-term financial stability.

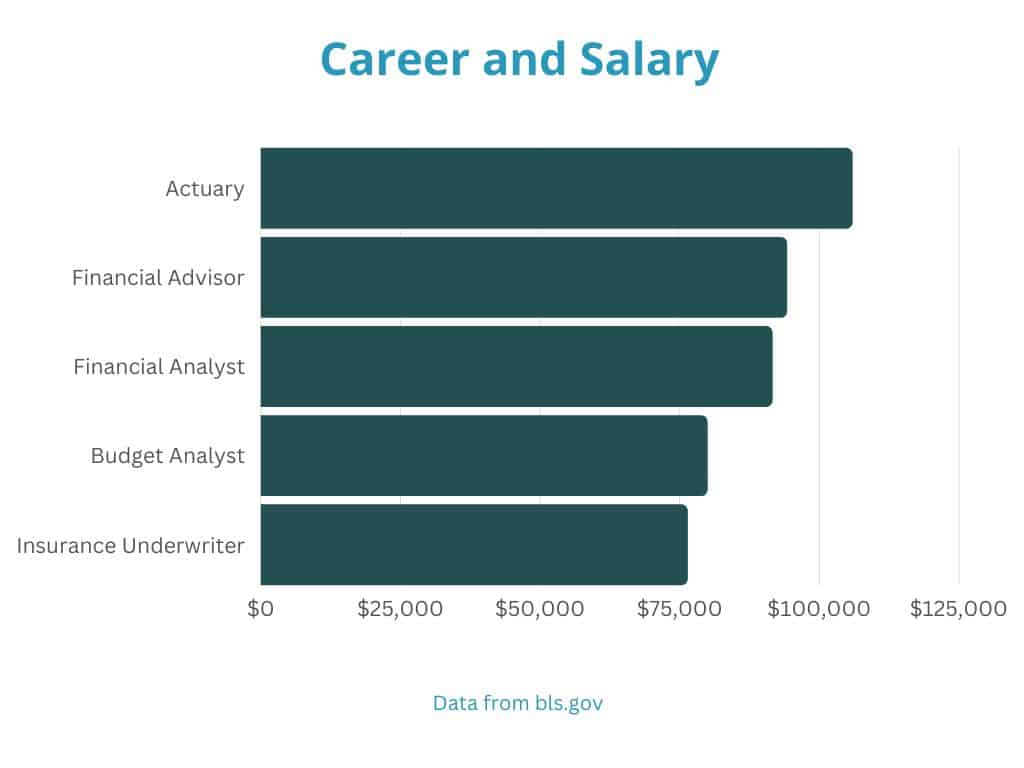

- Career Advancement: A master’s degree in personal finance can lead to increased earning potential and improved career prospects. Individuals can pursue roles such as financial advisors, investment managers, or personal finance consultants, potentially earning higher salaries and experiencing greater job satisfaction.

- Return on Investment (ROI): The ROI of an online master’s program in personal finance depends on factors like the program’s cost, the student’s existing financial knowledge, and the specific career path pursued. Individuals can expect to see a significant return on their investment if they successfully leverage the knowledge gained to advance their careers.

Student Reviews and Testimonials

Student feedback provides crucial insights into the effectiveness and value of online Master’s programs in personal finance. Direct accounts from current and former students offer a unique perspective, often highlighting aspects of the curriculum, instruction, and overall student experience that objective analyses might miss. This data is particularly valuable in assessing program quality and making informed decisions.

Importance of Student Reviews

Student reviews and testimonials offer a powerful window into the lived experience of online Master’s programs. They go beyond the program’s stated goals and objectives, revealing the program’s strengths and weaknesses through real-world application. These firsthand accounts can illuminate the learning environment, the quality of instruction, and the overall value proposition of the program. This qualitative data, combined with quantitative assessments, helps paint a more comprehensive picture of the program.

Methods for Identifying and Analyzing Student Reviews

Gathering and analyzing student reviews requires a structured approach. Online platforms like program websites, review aggregators (e.g., Course Report, Capterra), and social media groups can be invaluable sources. These platforms often allow students to provide feedback on specific aspects of the program, such as course content, instructor interaction, and program structure. A careful review of these platforms is crucial, focusing on consistency in the feedback and looking for trends in positive and negative comments.

Factors Contributing to Positive Student Feedback

Several key factors consistently contribute to positive student feedback. Engaging instructors who foster a supportive learning environment are highly valued. Well-structured courses that provide practical application of concepts are also important. Flexible online platforms that accommodate diverse learning styles are often cited as significant strengths. Students frequently praise programs that offer strong career support, such as networking opportunities and job placement assistance.

Examples of Student Reviews and Testimonials

“The program’s structure was perfect for my schedule. I appreciated the flexibility of the online format and the engaging lectures.”

John Doe, 2023 Graduate.

“The instructors were fantastic! Their real-world experience and insightful feedback were invaluable.”

Jane Smith, Current Student.

“I was initially hesitant about an online program, but the resources and support available exceeded my expectations.”

David Lee, 2022 Graduate.

Using Reviews to Assess Program Quality

Student reviews can significantly impact a program’s perceived quality. A high volume of positive feedback, coupled with consistent praise for specific program features, strongly suggests a well-regarded program. Conversely, a significant number of negative reviews focused on particular aspects, such as poor course materials or inflexible scheduling, should raise red flags. These reviews are not only useful for program evaluation but also for identifying areas for improvement.

Summary of Student Feedback

| Program | Strengths (Based on Reviews) | Weaknesses (Based on Reviews) |

|---|---|---|

| Program A | Engaging instructors, practical application, flexible format | Limited career support |

| Program B | Comprehensive curriculum, strong online platform | Less individual instructor interaction |

| Program C | Excellent career services, strong networking opportunities | Potentially demanding course load |

Final Conclusion

In conclusion, this analysis of online master’s programs in personal finance reveals a range of options catering to diverse learning styles and career aspirations. The programs examined vary significantly in curriculum depth, structure, and cost. Ultimately, the ideal program depends on individual needs and goals. Careful consideration of course content, program structure, accreditation, and cost will guide prospective students to the best fit for their educational and professional objectives.