Aspiring finance professionals eyeing a master’s degree from New York University’s prestigious finance program face significant financial considerations. Understanding the program’s tuition, fees, and available financial aid is crucial for making informed decisions. This comprehensive overview delves into the costs associated with pursuing a master’s in finance at NYU, examining tuition structures, living expenses in New York City, and the various financial aid options available to students.

The program’s curriculum, specializations, and potential career paths will be examined, alongside a comparison with other top US finance programs. A detailed breakdown of tuition costs, fees, and living expenses will provide a clear picture of the financial commitment involved. Furthermore, a thorough exploration of financial aid opportunities, scholarships, grants, and loan options will empower prospective students to navigate the complexities of financing their education.

NYU Master’s in Finance Program Overview

The NYU Stern School of Business’s Master of Science in Finance program is a highly regarded program, attracting students seeking advanced financial knowledge and career opportunities. This rigorous program equips students with a comprehensive understanding of financial markets, instruments, and strategies. The program’s emphasis on practical application and real-world case studies distinguishes it from other academic programs.The program’s reputation and robust curriculum have solidified its position as a premier destination for aspiring finance professionals, providing a strong foundation for a successful career in the field.

Program Specializations

The NYU Stern School of Business Master of Science in Finance program offers a variety of specializations. These specializations allow students to tailor their studies to specific areas of interest within finance. These specializations may not be formally offered as separate tracks, but rather, are integrated into the curriculum. Examples include: asset management, financial engineering, and investment banking, providing students with specialized expertise within the broader field of finance.

Curriculum Structure and Course Offerings

The curriculum is designed to provide a comprehensive understanding of financial concepts and practical application. Core courses cover topics such as financial markets, portfolio management, corporate finance, and risk management. Students can also select elective courses in areas like alternative investments, quantitative finance, or international finance. The program emphasizes practical application through case studies, real-world projects, and simulations.

Students may participate in research projects, and often work closely with faculty members.

Typical Career Paths for Graduates

Graduates of the NYU Stern School of Business Master of Science in Finance program are well-positioned for a range of career paths in the financial industry. Many graduates secure roles in investment banking, asset management, private equity, and hedge funds. Their strong analytical skills and practical knowledge make them highly sought after by top financial institutions. Additionally, some graduates pursue careers in financial consulting or academia.

Comparison to Other Top US Finance Programs

| Program | Location | Key Strengths | Notable Differences |

|---|---|---|---|

| NYU Stern School of Business (Finance) | New York City | Strong industry connections, emphasis on practical application, diverse course offerings | Large class sizes, focus on career services and networking opportunities |

| Wharton (Finance) | Philadelphia | Renowned faculty, robust research opportunities, strong alumni network | More theoretical focus, potentially less emphasis on practical experience |

| MIT Sloan (Finance) | Cambridge, MA | Focus on quantitative analysis, advanced technical skills, strong research orientation | Potentially higher emphasis on technology-focused finance |

| Columbia Business School (Finance) | New York City | Strong connections with Wall Street firms, rigorous curriculum, diverse specializations | May have a slightly more traditional approach compared to NYU |

The table above provides a comparative overview of four leading US finance programs. It highlights their locations, key strengths, and subtle differences in approach. Factors like the emphasis on quantitative analysis, practical application, or research opportunities can vary between programs. This should aid prospective students in making informed decisions based on their individual career goals.

Tuition and Fees

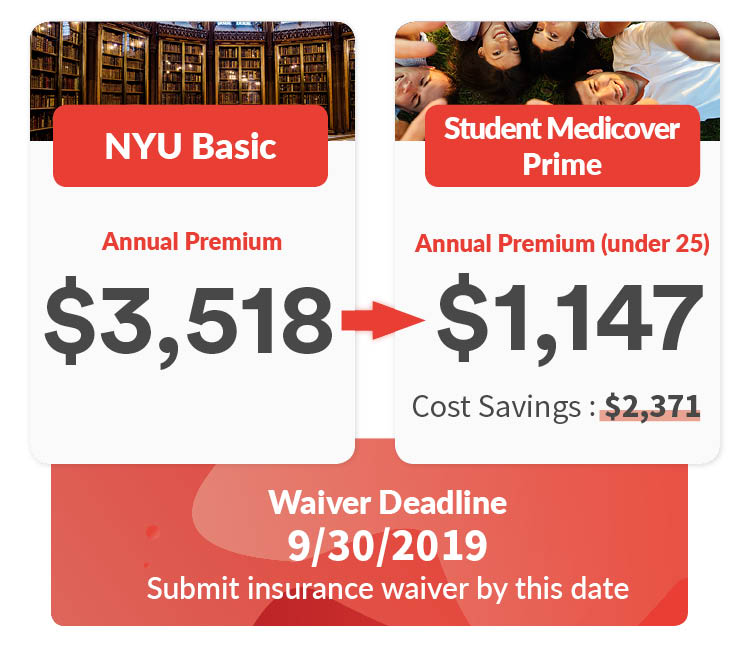

The NYU Stern School of Business’s Master of Science in Finance program carries significant financial obligations. Understanding the tuition structure, alongside living expenses in New York City, is crucial for prospective students to adequately plan their budgets. This section delves into the program’s costs, providing a comprehensive overview of fees and a comparison with similar programs.

Estimated Tuition Costs

The NYU Stern School of Business Master of Science in Finance program is a demanding undertaking. Significant tuition costs are a major factor for prospective students. While precise figures are often updated annually, estimated costs provide a valuable benchmark for budgeting purposes. These estimates are based on previous years’ tuition data, which should be regarded as an approximation, and not a definite price.

Breakdown of Tuition and Fees

Tuition fees encompass instructional materials, access to facilities, and administrative services. Additional fees may cover graduation ceremonies, student activities, and other program-related services. It is crucial for students to scrutinize all fees associated with the program to fully understand the financial commitment.

Cost of Living in New York City

New York City’s cost of living is a critical factor to consider alongside program tuition. Housing, groceries, transportation, and entertainment expenses are all substantial in this urban environment. Accommodation options vary widely in price, ranging from apartments in shared housing to private residences. Prospective students should research and develop a realistic budget for living expenses in New York City.

Comparison with Other Comparable Programs

The tuition costs of the NYU Stern School of Finance Master’s program are frequently compared to other esteemed finance programs. This comparison provides insight into the relative value and investment required for each program. Factors such as program reputation, faculty expertise, and career placement support are considered. Variations in curriculum, specializations, and extra-curricular activities further contribute to these comparisons.

Two-Year Tuition and Fee Summary

| Year | Tuition (Estimated) | Fees (Estimated) | Total Estimated Costs |

|---|---|---|---|

| 1 | $XX,XXX | $XXX | $XX,XXX |

| 2 | $XX,XXX | $XXX | $XX,XXX |

| Total (Estimated) | $XX,XXX | $XXX | $XX,XXX |

Note: “XX,XXX” represents placeholder values. Exact figures should be verified directly with the program’s official website.

Financial Aid Options

NYU’s Master of Science in Finance program, while prestigious, comes with a substantial tuition cost. Fortunately, numerous financial aid opportunities are available to prospective and current students, easing the financial burden and making the program more accessible. These options range from grants and scholarships to loans and fellowships, catering to various financial needs and circumstances.Financial aid packages are meticulously crafted to help students meet the program’s expenses.

Each student’s individual financial situation and academic performance are carefully considered when determining the appropriate aid. This ensures a fair and equitable approach to supporting students pursuing their academic goals.

Financial Aid Opportunities

Numerous financial aid opportunities are available to students, aiming to reduce the financial strain associated with graduate studies. These include merit-based scholarships, need-based grants, and loans, along with other specialized funding sources. The specific options and eligibility requirements may vary based on the individual’s circumstances and the particular program.

Application Process for Financial Aid

The application process for financial aid typically involves completing the Free Application for Federal Student Aid (FAFSA). This form collects essential financial information, enabling the institution to assess eligibility for federal grants and loans. Additional application forms specific to NYU may also be required, outlining the program-specific requirements. Students should consult the NYU website for detailed instructions and deadlines.

Eligibility Criteria for Various Aid Programs

Eligibility for financial aid programs is determined by various factors. Need-based aid typically considers financial resources and family income, while merit-based aid often focuses on academic achievements and demonstrated potential. Specific criteria for each program are clearly Artikeld in the program’s description, ensuring transparency and clarity for prospective students.

Scholarships Available for Finance Students

NYU offers a range of scholarships tailored to finance students. These scholarships may be awarded based on academic performance, financial need, or specific skills and interests. Prospective students should diligently research and apply for scholarships that align with their qualifications and goals. Some examples include scholarships for students pursuing a specific area within finance, like quantitative finance or investment banking.

Summary Table of Financial Aid

| Type of Financial Aid | Description | Estimated Amount (USD) |

|---|---|---|

| Federal Grants | Need-based financial aid from the federal government | $3,000 – $10,000 (variable) |

| NYU Scholarships | Merit-based and need-based scholarships offered by NYU | $2,000 – $15,000 (variable) |

| External Scholarships | Scholarships from external organizations or foundations | $1,000 – $25,000+ (variable) |

| Student Loans | Loans from banks or government agencies | $10,000 – $50,000+ (variable) |

Note: Amounts are estimates and can vary based on individual circumstances and program requirements.

Learn about more about the process of What are the essential skills taught in a master’s program for financial advisors? in the field.

Scholarships and Grants

Securing funding for graduate studies in finance is crucial, and NYU’s Master’s in Finance program, while rigorous, offers various avenues for financial support. Beyond program-specific aid, external scholarships and grants tailored to finance and graduate studies can significantly alleviate the financial burden. Students should diligently explore all options to maximize their chances of funding.

NYU Master’s in Finance Program Scholarships

The NYU Stern School of Business, home to the Master’s in Finance program, offers a variety of merit-based and need-based scholarships. These scholarships are often awarded based on academic excellence, demonstrated financial need, and exceptional contributions to the program. Application procedures are detailed within the program’s financial aid guidelines. The specific criteria and award amounts fluctuate annually, so prospective students should refer to the official NYU Stern website for up-to-date information.

External Scholarships for Finance and Graduate Study

Numerous external scholarships cater to finance and graduate study, often requiring a competitive application process. These scholarships frequently prioritize academic achievements, relevant work experience, leadership qualities, and demonstrated financial need. The application process typically involves completing an application form, submitting transcripts, letters of recommendation, and sometimes a personal statement.

- Fullbright Scholarships: These prestigious awards are typically granted to individuals pursuing advanced degrees and offer substantial financial support. Eligibility is often based on academic merit, leadership skills, and a commitment to international relations or academic exchange.

- Government Grants for Graduate Students: Federal and state governments sometimes offer grants to graduate students, particularly those demonstrating financial need and a commitment to specific fields like finance. The specific criteria and availability vary depending on the region and year. Information about these opportunities can be found through the Department of Education and relevant state education agencies.

- Private Foundation Grants: Numerous private foundations support graduate studies in finance. These grants often target students from underrepresented backgrounds, those with exceptional financial need, or those pursuing research in specific areas of finance. Researching foundation websites is key to discovering relevant opportunities.

- Industry-Specific Scholarships: Financial institutions and organizations frequently offer scholarships to students pursuing careers in finance. These scholarships may prioritize experience in the field or align with the sponsoring institution’s values.

Application Process for Scholarships and Grants

A systematic approach to scholarship applications is vital. Thoroughly reviewing the application guidelines, deadlines, and required documentation for each scholarship is crucial. Creating a spreadsheet or calendar to track applications, deadlines, and submission statuses is strongly recommended. Maintaining organized records of all supporting documents, such as transcripts, letters of recommendation, and personal statements, is essential for a successful application process.

Eligibility Criteria for Scholarships

Eligibility requirements for scholarships and grants vary widely. Students should meticulously review the specific criteria for each opportunity, as they often focus on academic merit, financial need, leadership skills, relevant work experience, and personal qualities. Understanding the prerequisites and deadlines associated with each scholarship or grant is critical for a timely and effective application process. Often, these requirements are detailed within the official scholarship guidelines.

Loan Options and Repayment

Securing funding for a master’s degree in finance often involves student loans. Understanding the available options, associated terms, and repayment strategies is crucial for prospective students. This section details various loan programs, including federal and private options, along with repayment plans and potential interest rates. It also explores loan forgiveness programs tailored to the finance industry.

Federal Student Loans

Federal student loans are a common source of funding for graduate studies. These loans often offer more favorable terms and repayment options compared to private loans. Federal programs typically have fixed interest rates and flexible repayment plans. The government often provides income-driven repayment plans, allowing borrowers to adjust monthly payments based on their income and family size.

These plans aim to make loan repayment more manageable.

Types of Federal Student Loans

- Direct Unsubsidized Loans: These loans do not require borrowers to demonstrate financial need and typically have a fixed interest rate. Borrowers are responsible for interest that accrues during the grace period before repayment begins.

- Direct PLUS Loans: Available to graduate students, PLUS loans often have higher interest rates than unsubsidized loans. Borrowers must meet creditworthiness criteria.

- Federal Perkins Loans: A need-based loan program with lower interest rates. However, availability and loan amounts may be limited.

Private Student Loans

Private lenders also offer student loans for graduate programs. These loans may have variable interest rates, which can fluctuate based on market conditions. Repayment plans and terms often vary depending on the lender. Borrowers should carefully review all loan terms and conditions before committing to a private loan.

Loan Repayment Options

Federal student loan programs offer several repayment options, allowing borrowers to tailor their monthly payments to their financial situation. These options include standard repayment, extended repayment, graduated repayment, income-driven repayment, and income-contingent repayment plans.

Loan Forgiveness Programs

Certain professions, including some in finance, might qualify for loan forgiveness programs. These programs can completely or partially eliminate remaining loan balances under specific conditions. Eligibility requirements and program details vary. The Public Service Loan Forgiveness (PSLF) program is one example, allowing forgiveness for qualifying public service jobs.

Interest Rates and Terms

Interest rates on student loans can vary significantly based on the loan type, lender, and borrower’s creditworthiness. Fixed-rate loans have a stable interest rate throughout the loan period. Variable-rate loans adjust to market conditions. Borrowers should carefully compare loan terms, including interest rates, fees, and repayment options, before selecting a loan.

Loan Comparison Table

| Loan Type | Interest Rate (Example) | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Direct Unsubsidized Loan | Around 6% (fixed) | Standard, extended, graduated, income-driven | No specific financial need requirement |

| Direct PLUS Loan | Around 8% (fixed) | Standard, extended, graduated, income-driven | Creditworthiness requirements |

| Private Student Loan | Variable, ranging from 6% to 12% | Variable based on lender | Creditworthiness requirements |

Cost of Living in NYC

The vibrant energy of New York City comes at a price. Living in the Big Apple, while offering unparalleled opportunities, demands careful financial planning, especially for students pursuing graduate degrees. Understanding the nuances of the city’s cost of living is crucial for prospective master’s students in finance to make informed decisions about their budgets.

Average Cost of Living in NYC

New York City boasts a dynamic economy and a high standard of living, but this comes with a significant financial burden. The average cost of living in NYC is considerably higher than the national average and often surpasses that of other major US metropolitan areas. Factors such as high real estate prices, robust demand for goods and services, and a large population contribute to this elevated cost.

Accommodation Costs

Finding affordable housing in NYC can be a significant challenge. Apartment rentals, especially in desirable neighborhoods, are often priced significantly higher than in other major cities. Studios and one-bedroom apartments are typically more expensive, while larger, multi-bedroom apartments often command even higher rents. The cost of utilities, such as electricity, heating, and water, should also be factored into the overall accommodation expense.

Food Costs

Dining out in NYC, a city known for its diverse culinary scene, can be a significant expense. Restaurants, cafes, and grocery stores all contribute to the cost of food. Preparing meals at home, while more economical, still requires careful budgeting. The costs for produce, meat, and other groceries in NYC are generally higher than in other parts of the country.

Transportation Costs

NYC’s extensive public transportation system, including the subway and buses, is crucial for navigating the city. Monthly passes or individual fares can quickly add up. While public transportation is a cost-effective option compared to car ownership, it still represents a significant expense for daily commuting.

Daily Necessities

Everyday items like toiletries, cleaning supplies, and personal care products are often more expensive in NYC. Prices for these necessities can vary depending on the retailer and the specific items. Retail prices for these daily necessities are often influenced by factors like supply chain and retailer margins.

Comparison with Other Major US Cities

Compared to other major US cities, NYC generally has a higher cost of living. Cities like Los Angeles, Chicago, and San Francisco also have high costs, but NYC often outpaces them in several key areas. The cost of living in NYC, however, is directly correlated with the city’s robust economy, higher salaries, and job opportunities.

Average Monthly Cost of Living in NYC

| Category | Average Monthly Cost |

|---|---|

| Rent | $2,500 – $4,500 |

| Food | $500 – $1,000 |

| Transportation | $200 – $400 |

| Utilities | $150 – $300 |

| Daily Necessities | $100 – $250 |

| Entertainment | $150 – $500 |

| Other Expenses | $100 – $300 |

Note: These are approximate figures and may vary based on lifestyle choices and specific locations within the city.

Budgeting and Planning

Navigating the financial landscape of graduate school requires meticulous planning and budgeting. Master’s programs in finance, while offering valuable knowledge and career prospects, often come with significant financial responsibilities. Students must carefully consider tuition, fees, living expenses, and potential loan obligations to ensure a smooth and successful academic journey.Successful financial management during and after graduate school hinges on a well-defined budget, proactive saving strategies, and careful consideration of potential financial aid options.

This section details the critical steps to creating a personalized budget and strategies for maintaining financial stability throughout the program and beyond.

Creating a Graduate School Budget

A comprehensive budget is the cornerstone of financial stability during graduate studies. It allows students to track income and expenses, identify areas for potential savings, and make informed financial decisions.

- Income Sources: List all sources of income, including scholarships, grants, part-time jobs, and existing savings. Accurate income projections are crucial for realistic budgeting.

- Expenses Breakdown: Categorize all anticipated expenses, including tuition, fees, accommodation, food, transportation, books, supplies, and personal expenses. Detailed breakdowns provide a clear picture of financial commitments.

- Savings Allocation: Allocate a portion of income to savings, recognizing that unexpected costs can arise during graduate studies. Setting aside funds for emergencies is vital for maintaining financial stability.

- Financial Aid Options: Thoroughly research and apply for all available financial aid, including scholarships, grants, and loans. Understanding these options will significantly reduce the financial burden of graduate school.

Managing Finances During the Program

Maintaining financial discipline throughout the program is critical. Effective strategies can mitigate financial strain and optimize resources.

- Expense Tracking: Utilize budgeting apps or spreadsheets to meticulously track expenses. This helps identify potential areas for cost reduction and maintain awareness of spending patterns.

- Emergency Fund: Building an emergency fund can provide a safety net against unexpected expenses, such as medical bills or equipment malfunctions. This is crucial for maintaining financial stability during the program.

- Part-time Work: Explore part-time employment opportunities to supplement financial resources and gain practical experience. Balancing studies with work requires careful time management and scheduling.

- Negotiation Strategies: Negotiating fees or seeking discounts for supplies and services can significantly reduce financial burden.

Financial Planning After the Program

Financial planning extends beyond the duration of the program. A proactive approach is crucial for a successful transition into the professional world.

- Debt Management: Develop a plan to manage any student loan debt, including understanding repayment options and exploring strategies to minimize the financial impact of loan obligations.

- Investment Strategies: Understanding basic investment strategies can be beneficial for building long-term financial security. This includes knowledge of different investment vehicles and risk tolerance.

- Long-Term Goals: Establish long-term financial goals, such as purchasing a home or saving for retirement. Financial planning should be aligned with personal aspirations.

- Professional Development: Continuous learning and professional development can increase earning potential and financial stability after the program.

Sample Budget Template

A sample budget template provides a framework for students to create their own personalized budget. This template Artikels key categories and encourages students to tailor it to their specific needs and circumstances.

| Category | Estimated Monthly Expenses |

|---|---|

| Tuition and Fees | $XXX |

| Accommodation | $XXX |

| Food | $XXX |

| Transportation | $XXX |

| Books and Supplies | $XXX |

| Personal Expenses | $XXX |

| Savings | $XXX |

| Total Expenses | $XXX |

Budgeting Process Flowchart

A flowchart visually Artikels the budgeting process, providing a clear and concise overview of the steps involved.

Ultimate Conclusion

In conclusion, pursuing a master’s in finance at NYU involves significant financial planning. This article has provided a detailed analysis of tuition costs, financial aid, and living expenses, equipping prospective students with the necessary information to make informed decisions. From program structure to career prospects, and from scholarships to loan options, this in-depth look at the financial realities of pursuing a master’s in finance at NYU will empower students to embark on their academic journey with confidence.