Navigating the financial planning landscape requires careful consideration. A Certified Financial Planner (CFP) certification and a Master’s in Personal Financial Planning offer distinct pathways. This analysis delves into the educational requirements, career prospects, and financial commitments associated with each option, empowering individuals to make informed decisions.

The choice hinges on individual career goals, financial resources, and learning preferences. Factors like curriculum, potential earnings, and time commitment play crucial roles in determining the optimal path. This article provides a comprehensive comparison to guide readers through this crucial decision-making process.

Introduction to Financial Planning Certifications

The financial planning landscape offers diverse pathways to expertise, each with unique requirements and career implications. Choosing between a Certified Financial Planner (CFP) certification and a Master’s in Personal Financial Planning hinges on individual goals, time commitment, and financial resources. Both credentials open doors to fulfilling careers in the financial services industry, but the routes to achieving them differ significantly.This exploration delves into the specific requirements, career prospects, and costs associated with each certification path, providing a comprehensive overview to aid prospective financial planners in making informed decisions.

CFP Certification

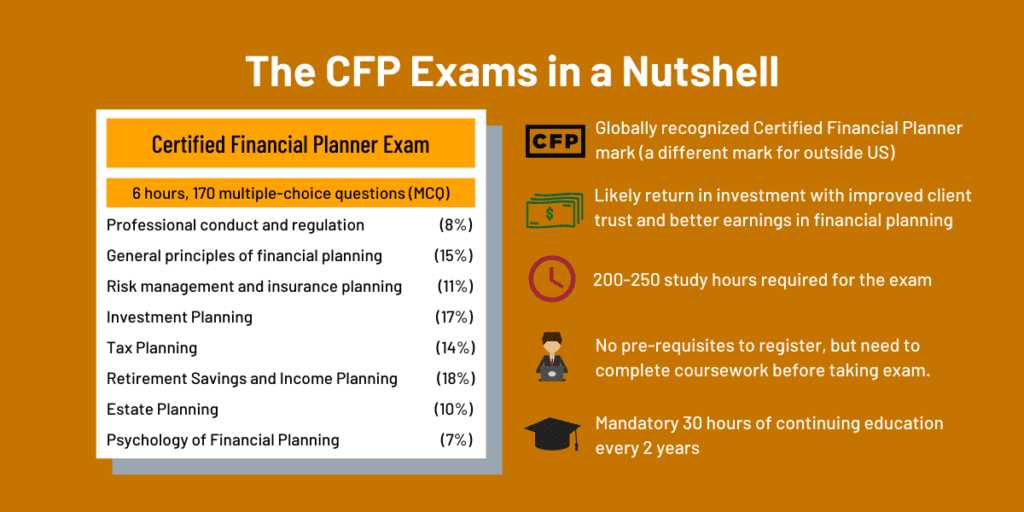

The CFP certification is a globally recognized credential demonstrating competency in financial planning. It’s a rigorous process that demands a high standard of knowledge and ethical conduct.

- Educational Requirements: A bachelor’s degree is typically required, along with specific coursework in finance, economics, and related fields. Experience in the field can also be a factor, but often a combination of education and experience is necessary.

- Prerequisites: Passing the CFP exam, which tests knowledge in areas such as investment planning, retirement planning, estate planning, and insurance. Applicants must also adhere to the CFP Board’s ethical standards.

- Career Paths: CFPs can work in various roles, including financial advisors, investment managers, and insurance agents. The scope of practice depends on individual expertise and experience, and many CFPs work independently or for firms providing financial advisory services.

- Time Commitment: The time commitment varies, but typically includes coursework, exam preparation, and potentially ongoing continuing education requirements. Aspiring CFPs should expect a substantial time investment to complete the process.

Master’s in Personal Financial Planning

A Master’s degree in Personal Financial Planning offers a more in-depth academic approach to financial planning, encompassing both theoretical and practical aspects.

- Educational Requirements: A bachelor’s degree in a relevant field (like finance, economics, or business) is usually required. Specific coursework within the master’s program will delve deeper into financial planning concepts and strategies.

- Prerequisites: Strong academic performance and often specific prerequisites in mathematics, statistics, and economics. Admission to a master’s program often involves a review of academic transcripts and personal statements.

- Career Paths: Graduates can pursue careers as financial advisors, wealth managers, or other roles within the financial services industry. The degree often provides a more comprehensive understanding of financial planning principles and advanced techniques.

- Time Commitment: A Master’s degree typically requires a longer time commitment than obtaining a CFP certification, usually ranging from one to two years of study.

Cost Comparison

The financial investment in each path varies considerably. Factors like tuition, fees, exam costs, and study materials contribute to the overall expense.

| Credential | Tuition (Estimated) | Exam Fees | Materials (Estimated) | Other Fees | Total Estimated Cost |

|---|---|---|---|---|---|

| CFP Certification | $0 (Often, prior education covers the majority of the needed knowledge) | $650 – $750 | $200 – $500 | $100 – $200 (application, etc.) | $1,000 – $1,600 |

| Master’s in Personal Financial Planning | $25,000 – $50,000 (per year) | $0 (Often included in tuition) | $500 – $1,500 | $500 – $1,000 (fees, books) | $30,000 – $60,000 (per program) |

Note: Costs are estimates and may vary based on specific programs and institutions.

Curriculum and Learning Outcomes

Choosing between a CFP certification and a Master’s in Personal Financial Planning hinges significantly on the desired curriculum and the specific learning outcomes. Both paths equip individuals with valuable financial planning skills, but the depth and breadth of knowledge vary considerably. A critical evaluation of the curriculum’s components and the practical application of acquired knowledge is essential in making an informed decision.

Core Curriculum Components

The core curriculum for a CFP certification typically focuses on the foundational principles of financial planning, including budgeting, investment strategies, risk management, estate planning, and retirement planning. A Master’s program in Personal Financial Planning, on the other hand, delves deeper into these topics, incorporating advanced concepts, quantitative analysis, and in-depth case studies. These programs often emphasize ethical considerations, legal implications, and sophisticated financial modeling techniques.

Learning Outcomes and Skills Developed

CFP certification programs prioritize the development of practical, application-oriented skills in financial planning. Graduates gain proficiency in conducting client interviews, creating financial plans, and recommending appropriate investment strategies. A Master’s program, however, emphasizes a more theoretical and analytical approach. Students develop advanced analytical skills, including data interpretation, financial modeling, and risk assessment. Furthermore, they often acquire a deeper understanding of economic principles and market dynamics, leading to more nuanced financial planning strategies.

Practical Application of Knowledge

The practical application of knowledge gained through a CFP certification is largely focused on client interaction and providing personalized financial guidance. Real-world experience, often through internships or case studies, is crucial in translating theoretical concepts into tangible outcomes. A Master’s program in Personal Financial Planning, conversely, emphasizes the application of advanced techniques, allowing graduates to develop more complex and sophisticated financial plans, potentially targeting high-net-worth individuals or businesses.

This includes advanced investment strategies and sophisticated portfolio management.

Comparison of Specific Courses/Modules

A CFP certification program typically includes modules on insurance planning, retirement planning, investment strategies, tax planning, and estate planning. A Master’s program, in contrast, expands upon these topics with more advanced courses such as quantitative finance, financial modeling, portfolio management, and advanced investment strategies. Specific course content can vary significantly between institutions, so careful research is essential.

Table: Areas of Focus and Competencies

| Program | Areas of Focus | Specific Competencies Developed |

|---|---|---|

| CFP Certification | Client Relationship Management, Basic Financial Planning, Investment Principles, Insurance, Retirement Planning | Conducting client interviews, developing basic financial plans, recommending appropriate investment products, providing comprehensive advice, understanding legal and ethical considerations |

| Master’s in Personal Financial Planning | Advanced Financial Modeling, Quantitative Analysis, Portfolio Management, Risk Management, Estate Planning, Taxation | Developing sophisticated financial models, analyzing complex financial situations, managing investment portfolios for high-net-worth clients, applying advanced risk assessment techniques, and understanding complex tax laws. |

Time Commitment and Financial Investment

Choosing between a CFP certification and a Master’s in Personal Financial Planning often hinges on the investment of time and resources. Each path presents a unique commitment, impacting both the individual’s schedule and financial outlook. Understanding these factors is crucial for making an informed decision.

Browse the multiple elements of online master’s in personal finance curriculum comparison to gain a more broad understanding.

Estimated Time Commitment

The time required for completing either a CFP certification or a Master’s program varies considerably. A CFP certification typically involves a significant amount of study, including coursework, exam preparation, and potentially practical experience. Completion timeframes for CFP programs can range from several months to a year or more, depending on the individual’s pace and the chosen learning method.

A Master’s in Personal Financial Planning, on the other hand, generally requires a more extensive period of dedicated study, usually encompassing one to two years of full-time or part-time coursework.

Financial Investment

The financial commitment associated with each program also varies significantly. Tuition fees, required textbooks, and other program materials contribute to the overall cost. Furthermore, some programs may include additional expenses like exam fees and professional development workshops. The overall cost of a CFP certification can range from a few thousand dollars to several thousand, depending on the provider and program structure.

Master’s programs in personal financial planning can involve substantial tuition fees, often exceeding the cost of a CFP certification by a considerable margin.

Return on Investment

Assessing the return on investment (ROI) for each program involves considering the potential salary increase and career advancement opportunities. A CFP certification can open doors to higher-paying financial planning roles and enhance career prospects. For example, certified financial planners often command higher salaries compared to their non-certified counterparts. A Master’s degree, however, can provide a more specialized skill set and potentially open up even more advanced and lucrative career opportunities, such as research, teaching, or specialized financial advisory positions.

The ROI of a Master’s program may take longer to materialize, but the potential for higher earnings and advanced career roles is often more pronounced.

Program Cost Breakdown

| Program | Tuition | Books & Materials | Exam Fees | Other Costs | Total Estimated Cost |

|---|---|---|---|---|---|

| CFP Certification | $3,000 – $7,000 | $500 – $1,000 | $500 – $1,000 | $500 – $1,500 (e.g., study materials, workshops) | $5,000 – $10,000 |

| Master’s in Personal Financial Planning | $20,000 – $50,000 | $1,000 – $2,000 | $500 – $1,000 | $1,000 – $3,000 (e.g., research, software) | $22,500 – $56,000 |

Note: Costs are estimates and can vary based on program provider, location, and individual circumstances.

Skill Sets and Practical Applications

Choosing between a CFP certification and a Master’s in Personal Financial Planning hinges on the specific skills and applications desired. Both paths equip individuals with valuable tools for navigating the complex world of personal finance, but the methodologies and depth of knowledge differ significantly. Understanding these distinctions is crucial for career advancement and effective client service.

Practical Skills Developed

The CFP certification program emphasizes practical application of financial planning principles through a standardized curriculum. This structured approach focuses on the practical aspects of building and managing financial plans, including budgeting, investment strategies, retirement planning, and estate planning. Master’s programs, on the other hand, often delve deeper into the theoretical underpinnings of personal finance, offering more flexibility and opportunity for specialized knowledge in specific areas like tax planning or wealth management.

Real-World Application Examples

A CFP professional might help a client develop a comprehensive financial plan incorporating investment strategies aligned with their risk tolerance and retirement goals. A master’s graduate might leverage their in-depth knowledge of tax laws to optimize a client’s estate plan, maximizing tax efficiency. In both cases, the skills developed are applied to solve specific financial problems and achieve defined objectives for the client.

Problem-Solving and Decision-Making

Both pathways cultivate problem-solving and decision-making abilities. The CFP certification, through its structured curriculum, hones the ability to analyze complex financial situations and apply established planning principles. Master’s programs often emphasize critical thinking and advanced analytical techniques, fostering a more nuanced and in-depth approach to decision-making. This includes understanding the complexities of financial instruments, regulations, and market conditions.

Ethical Considerations

Ethical considerations are paramount in both programs. A core component of the CFP certification involves adhering to a strict code of ethics, ensuring transparency, objectivity, and fiduciary responsibility in client interactions. Master’s programs typically integrate ethical considerations into various courses, emphasizing the importance of professional conduct and responsible financial planning practices. The ethical guidelines of both pathways are designed to safeguard the interests of clients and maintain public trust in the profession.

Case Study Illustration

Consider a client facing significant debt and struggling to manage their finances. A CFP professional would likely develop a debt reduction strategy incorporating budgeting, debt consolidation, and financial literacy education. A master’s graduate might conduct a more thorough analysis, considering the client’s financial history, tax implications, and potential asset liquidation strategies. Both approaches would prioritize the client’s best interests, but the master’s graduate might delve deeper into complex financial scenarios and identify additional factors influencing the client’s situation.

Comparative Analysis of Skills Developed

| Skill | CFP Certification | Master’s in Personal Financial Planning |

|---|---|---|

| Financial Planning Principles | Strong foundation, practical application, standardized curriculum. | In-depth understanding of theoretical frameworks, diverse specializations. |

| Investment Strategies | Emphasis on risk tolerance and diversification, portfolio management. | Advanced knowledge of market analysis, sophisticated investment strategies. |

| Tax Planning | Basic tax implications integrated into broader financial plans. | Comprehensive tax strategies, optimizing tax liabilities. |

| Estate Planning | Basic estate planning considerations, will preparation guidance. | Advanced estate planning, wealth transfer strategies, trust management. |

| Problem Solving | Structured approach to identifying and resolving financial problems. | In-depth analysis and critical thinking to develop solutions. |

Choosing the Right Path

Deciding between a CFP certification and a Master’s in Personal Financial Planning hinges on individual circumstances and aspirations. Both pathways offer distinct advantages, but the optimal choice depends on the candidate’s career goals, financial situation, and preferred learning style. This crucial decision requires careful consideration of long-term career projections and the potential impact on future earnings and opportunities.Navigating this decision requires a clear understanding of the specific demands and rewards of each path.

A thorough self-assessment, considering personal circumstances and future ambitions, is paramount. The following analysis explores the factors that should guide this choice.

Factors Influencing the Decision

Individual factors like career ambitions, financial resources, and learning preferences significantly influence the choice between a CFP certification and a Master’s in Personal Financial Planning. A comprehensive understanding of these personal elements is crucial for making an informed decision.

Career Goals and Aspirations

Career goals play a pivotal role. A candidate aiming for a junior-level financial advisor position might find the CFP certification sufficient, whereas a seasoned professional seeking a leadership role or specialization in a niche area might benefit from a Master’s. Consideration should also be given to the desired level of specialization. For instance, a CFP certification often covers broad financial planning principles, while a Master’s may allow for advanced study in areas like estate planning or investment management.

Financial Situation and Resources

The financial investment in a Master’s degree is substantial and should be weighed against the potential return. A comprehensive evaluation of personal finances, including available funds and anticipated earnings, is necessary. The cost of a Master’s program, including tuition, fees, and living expenses, should be carefully evaluated alongside potential salary increases and career advancement opportunities.

Learning Style and Preferences

Learning styles vary. Some individuals thrive in structured, classroom-based environments, while others prefer self-directed learning. The nature of the program, whether it’s primarily classroom-based or self-paced online, should align with the learner’s preferred learning method. This ensures a productive and engaging learning experience.

Long-Term Career Aspirations

Long-term career aspirations significantly impact the decision. Aspiring financial advisors with ambitious plans for advanced roles or niche specializations might benefit more from the in-depth knowledge and specialized skills a Master’s degree provides. A thorough analysis of potential future career trajectories is essential.

Potential Impact on Earning Potential and Future Career Options

The choice between a CFP certification and a Master’s degree has direct implications for earning potential and career options. A Master’s degree often leads to higher earning potential and broader career paths. CFP certification, while valuable, typically opens doors to entry-level financial advisory roles. The decision should be carefully evaluated in light of anticipated future earnings and career progression.

Comparison of Paths

| Factor | CFP Certification | Master’s in Personal Financial Planning |

|---|---|---|

| Cost | Generally lower | Significantly higher |

| Time Commitment | Generally shorter | Longer |

| Earning Potential | Entry-level to mid-level | Potentially higher, depending on specialization and experience |

| Career Advancement | Entry-level to mid-level positions | Opportunities for advanced roles and specializations |

| Learning Depth | Broad overview of financial planning principles | In-depth knowledge and specialized skills |

| Learning Style | Can be self-directed or classroom-based | Typically classroom-based |

| Examples | Junior financial advisor, investment advisor | Senior financial advisor, estate planner, investment strategist |

This table summarizes the key differences, highlighting the various aspects to consider in the decision-making process. Each factor should be carefully evaluated in relation to the individual’s personal circumstances and aspirations.

Final Summary

Ultimately, the decision between a CFP certification and a Master’s in Personal Financial Planning is a personalized one. Weighing the educational demands, potential salary, and career aspirations will guide individuals towards the most suitable path. This comparison highlights the significant differences, enabling a clear understanding of the commitment and rewards associated with each option.