The rise of online learning has opened doors to advanced degrees for aspiring financial experts. This comprehensive guide explores the best online master’s programs in personal finance, designed specifically for beginners. Navigating the complexities of personal finances can be daunting, but these programs offer structured learning paths, equipping individuals with the knowledge and skills to build a secure financial future.

Understanding budgeting, investing, and debt management is crucial for success, and these programs provide the foundational knowledge necessary to take control.

From identifying reputable programs to understanding curriculum content and practical applications, this in-depth analysis will equip readers with the information needed to make informed decisions. It will delve into program costs, career opportunities, and support systems, ultimately helping aspiring financial professionals find the perfect online program to launch their careers.

Introduction to Online Master’s in Personal Finance for Beginners

A solid foundation in personal finance is crucial for navigating the complexities of modern life. Understanding how to manage income, expenses, debt, and investments empowers individuals to achieve financial security and independence. This knowledge is not just about accumulating wealth; it’s about building a future where financial worries are minimized, and opportunities are maximized.Personal finance, for beginners, encompasses the strategic management of an individual’s income, expenses, and assets.

It involves creating a budget, understanding debt management strategies, and making informed investment decisions. An online master’s degree in personal finance offers a structured and comprehensive approach to this crucial life skill.

Benefits of Pursuing an Online Master’s Degree

An online master’s degree in personal finance provides a structured and in-depth understanding of financial principles, exceeding what’s available in introductory courses. This advanced learning equips individuals with sophisticated strategies for managing personal finances. Early exposure to these principles offers significant advantages throughout life.

Importance of Early Understanding

Developing a strong understanding of personal finance early in life is paramount. This early education allows individuals to establish sound financial habits that can prevent financial struggles and enable them to take advantage of opportunities for wealth building. A well-structured approach can lead to financial security and independence, reducing financial stress and maximizing opportunities.

Key Components of a Comprehensive Personal Finance Education

A comprehensive personal finance education should cover various crucial aspects. These include budgeting, debt management, investing, saving, and understanding financial markets. Furthermore, risk management, emergency preparedness, and estate planning should also be included. These components, when combined, form a robust framework for effective personal financial management.

Learning Styles and Online Learning Suitability

Understanding individual learning styles is critical when choosing an online learning format. Different styles react differently to various methods. A comprehensive approach to personal finance education should be flexible and adaptive to accommodate diverse learning styles.

| Learning Style | Description | Strengths | Weaknesses |

|---|---|---|---|

| Visual Learner | Learns best through images, diagrams, and videos. | Visual aids can make complex concepts easier to grasp. | May struggle with purely text-based materials. Requires clear visual representations. |

| Auditory Learner | Learns best through listening to lectures, discussions, and audio explanations. | Lectures and discussions can reinforce understanding. | May struggle with passively absorbing information from written materials. Requires interactive elements. |

| Kinesthetic Learner | Learns best through hands-on activities, simulations, and practical exercises. | Hands-on practice can solidify knowledge and improve retention. | Requires structured opportunities for active participation. May require more time for learning. |

| Read/Write Learner | Learns best through reading, writing, and taking notes. | Effective for those who prefer to absorb information in written format. | May struggle with highly visual or auditory methods. Requires structured learning materials. |

Identifying Reputable Online Programs

Navigating the burgeoning online education market for personal finance master’s programs demands careful scrutiny. With numerous options vying for attention, discerning reputable programs from less-rigorous ones is crucial for students seeking a valuable investment in their financial knowledge and career prospects. A thorough understanding of program characteristics, specializations, and structures is essential to making an informed decision.Recognizing the importance of quality assurance, reputable online programs in personal finance exhibit specific features that set them apart.

These features typically involve robust curriculum design, experienced faculty, and a proven track record of student success. This section will provide a detailed examination of these key characteristics, facilitating the identification of trustworthy programs.

Key Characteristics of Reputable Programs

Reputable online master’s programs in personal finance typically demonstrate several key characteristics. These include a comprehensive curriculum encompassing core financial concepts, practical applications, and emerging trends. Faculty expertise in the field, often with significant industry experience, is another vital indicator. Furthermore, strong career services support is frequently offered, connecting graduates with potential employers and providing resources for professional development.

Potential Program Specializations

The field of personal finance offers diverse specializations, catering to various career aspirations. Examples include:

- Financial Planning for Individuals: This specialization focuses on the intricacies of personal financial planning, encompassing budgeting, investment strategies, retirement planning, and estate management for individual clients.

- Financial Planning for Businesses: This specialization provides a deep dive into the financial strategies for businesses, including budgeting, forecasting, financial analysis, and risk management.

- Wealth Management: This specialization delves into the management of high-net-worth individuals and families, focusing on sophisticated investment strategies, tax optimization, and philanthropic planning.

- Behavioral Finance: This specialization explores the psychological aspects of financial decision-making, helping students understand how cognitive biases influence investment choices and financial behavior.

Program Structures

Online master’s programs in personal finance can adopt various structures, impacting the learning experience.

- Course-based programs: These programs typically follow a structured sequence of courses, each covering a specific aspect of personal finance. This approach offers a comprehensive overview of the field, suitable for students seeking a well-rounded education.

- Project-based programs: These programs emphasize practical application through real-world projects. Students often work on case studies, simulations, or client projects, allowing them to develop hands-on experience and build a portfolio. This structure is often more suited for students seeking immediate practical application of their knowledge.

Comparison of Online Programs

The table below compares three popular online programs in personal finance, highlighting key aspects like curriculum, cost, and accreditation.

| Program Name | Curriculum Highlights | Cost | Accreditation |

|---|---|---|---|

| Master of Science in Financial Planning (University A) | Comprehensive coverage of financial planning principles, investment strategies, and risk management. Includes practical application through case studies. | $XX,XXX (estimated) | Accredited by [Accreditation Body] |

| Master of Personal Finance (University B) | Focuses on practical applications, including client interactions and portfolio management. Emphasizes behavioral finance principles. | $YY,YYY (estimated) | Accredited by [Accreditation Body] |

| Online Certificate in Personal Finance (Institution C) | Concentrates on core financial concepts, budgeting, and investing. | $ZZ,ZZZ (estimated) | Accredited by [Accreditation Body] |

Factors to Consider When Choosing a Program

Several factors are critical when evaluating online master’s programs in personal finance.

- Faculty Expertise: Look for faculty with substantial experience in the field, potentially holding industry certifications or publishing research.

- Accreditation: Ensure the program is accredited by a recognized accrediting body, such as the [relevant accreditation body]. Accreditation signifies the program meets certain quality standards.

- Career Services: A robust career services department offering job placement assistance, networking opportunities, and professional development resources can significantly enhance a student’s career prospects.

- Program Structure: Carefully consider the program’s structure (course-based or project-based) to determine its alignment with your learning style and career goals.

Curriculum and Course Content

Online master’s programs in personal finance for beginners are increasingly popular, offering accessible avenues for individuals to gain expertise in managing their financial well-being. These programs aim to equip students with a comprehensive understanding of various financial concepts and tools, enabling them to make informed decisions regarding budgeting, investing, and debt management. The curriculum typically incorporates theoretical frameworks alongside practical applications, preparing students for real-world financial challenges.The core focus of these programs lies in providing a structured learning experience that moves beyond basic financial literacy, enabling students to build robust financial strategies.

Students are expected to develop a strong foundation in critical financial concepts, learn practical skills, and apply their knowledge to real-world scenarios. This holistic approach differentiates these programs from introductory courses, enabling deeper exploration and application of learned principles.

Typical Curriculum Structure

Online master’s programs in personal finance often follow a structured curriculum designed to build progressively upon foundational knowledge. Modules typically cover a broad range of topics, ensuring a well-rounded understanding of the subject. These courses are not just theoretical, but they emphasize practical application through case studies and exercises.

Essential Topics Covered

The curriculum typically encompasses key areas of personal finance, including budgeting, investing, debt management, and financial planning. Budgeting principles are taught to establish financial control and track spending habits. Investment strategies, including stock market analysis and portfolio diversification, are often covered in detail. Debt management strategies, such as debt consolidation and repayment plans, are essential components, empowering students to navigate financial challenges effectively.

Financial planning tools and techniques, including retirement planning and estate planning, are also commonly addressed.

Teaching Methodologies

Different online programs employ diverse teaching methodologies. Some programs lean towards interactive online discussions and collaborative learning platforms, fostering a sense of community and shared learning. Others emphasize video lectures, pre-recorded content, and downloadable resources. The effectiveness of each method depends on individual learning styles and program design. The best programs often blend multiple approaches, creating a dynamic learning experience.

Practical Application

Practical application is crucial in personal finance education. Case studies, real-world examples, and hands-on exercises are integral to solidifying theoretical knowledge and applying it in real-life situations. For example, students might analyze hypothetical investment portfolios or develop personalized budgeting plans based on simulated income and expenses. This practical approach allows students to gain confidence in applying the learned concepts to their own circumstances.

A well-structured curriculum will incorporate real-world case studies relevant to personal finance topics.

Real-World Case Studies

Illustrative case studies can enhance the learning experience. A case study might involve a young professional navigating student loan debt and planning for their first home purchase. Another example could focus on a family planning for retirement, factoring in inflation and potential market fluctuations. These case studies help students visualize the application of learned principles in diverse scenarios.

Such examples provide a strong link between theoretical knowledge and real-world application, enhancing the program’s value and practicality.

Practical Application and Skill Development

Mastering personal finance requires more than just theoretical knowledge; it demands practical application. Online programs, while providing a strong foundation, must be coupled with consistent effort and real-world practice to yield tangible results. This section explores how to translate learned concepts into concrete actions, empowering individuals to take control of their financial future.Successful personal finance management is not a one-time event but a continuous process of learning, adaptation, and improvement.

By consistently applying the skills acquired through online programs, individuals can make significant progress in achieving their financial goals.

Budgeting Strategies

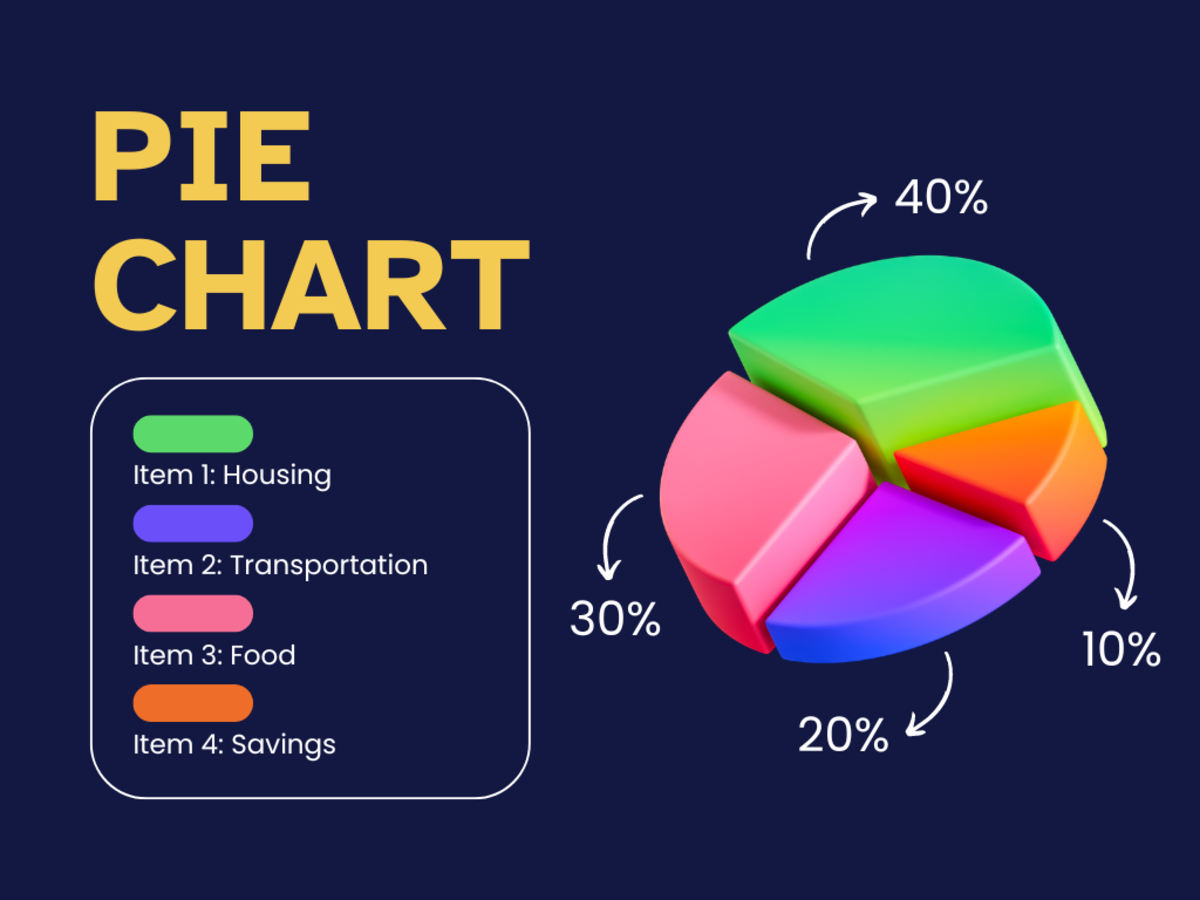

Effective budgeting is the cornerstone of sound personal finance. It involves meticulously tracking income and expenses to identify areas where funds can be optimized. A well-designed budget acts as a roadmap, guiding spending decisions and promoting financial discipline. It also helps in identifying areas where savings can be increased and expenses can be reduced.

- Zero-Based Budgeting: This method allocates every dollar of income to a specific category, ensuring that every penny has a purpose. This meticulous approach fosters awareness of spending habits and promotes responsible financial allocation. Example: A person earning $5,000 monthly would meticulously assign each dollar to specific categories like rent, food, transportation, savings, etc., ensuring that the total equals $5,000.

- Envelope System: This tangible method involves assigning cash to different categories (like groceries, entertainment, etc.). Once the allocated cash is spent, the individual cannot overspend in that area. This method fosters awareness of spending limitations and promotes mindful financial choices.

- 50/30/20 Rule: This simple guideline allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This straightforward approach provides a framework for balanced financial management, promoting long-term financial health.

Saving Strategies

Savings are the bedrock of financial security. Systematic saving allows individuals to build an emergency fund, pursue significant goals (like homeownership), and plan for retirement. The earlier savings habits are cultivated, the greater the potential for financial well-being.

- Automatic Transfers: Setting up automatic transfers from checking to savings accounts ensures consistent savings, regardless of spending habits. This systematic approach promotes consistency and reduces the risk of procrastination or missed savings opportunities.

- High-Yield Savings Accounts: These accounts offer competitive interest rates, maximizing the return on saved funds. Choosing a high-yield account can significantly accelerate the growth of savings over time.

- Emergency Fund: Establishing an emergency fund (typically 3-6 months of living expenses) provides a safety net during unforeseen circumstances. This crucial buffer protects individuals from financial distress during job loss, medical emergencies, or other unexpected events.

Investing Strategies

Investing is a crucial component of long-term financial growth. Understanding different investment vehicles and risk tolerance is vital for building wealth.

- Index Funds: These diversified investment funds track a specific market index, offering broad market exposure with relatively low fees. This approach is often preferred for its simplicity and broad market diversification.

- Mutual Funds: These investment funds pool money from multiple investors to invest in a variety of securities. Different mutual funds cater to various risk tolerances and investment goals.

- Stocks: Investing in individual stocks carries higher risk but also potentially higher returns. Thorough research and understanding of the company’s financial health are crucial before making investment decisions.

Debt Management

Effective debt management is crucial for achieving financial freedom. Strategies to manage debt effectively include creating a debt repayment plan, prioritizing high-interest debts, and considering debt consolidation or balance transfer options.

- Debt Avalanche: This method prioritizes paying off debts with the highest interest rates first. This strategy minimizes the overall interest paid over time.

- Debt Snowball: This method prioritizes paying off debts with the smallest balances first, often motivating individuals to continue their debt reduction efforts.

- Debt Consolidation: This involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify repayment and potentially reduce the overall cost of debt.

Financial Tools and Resources

Numerous financial tools and resources can aid in personal finance management. Online budgeting apps, financial planning software, and reputable financial advisors can provide invaluable support in navigating the complexities of personal finance.

Browse the implementation of online master’s in personal finance for international students in real-world situations to understand its applications.

- Online Budgeting Apps: Apps like Mint, Personal Capital, and YNAB (You Need a Budget) provide tools to track income, expenses, and create budgets.

- Financial Planning Software: Software packages provide comprehensive financial planning tools, including retirement planning, investment tracking, and debt management.

- Financial Advisors: Professional financial advisors can provide personalized guidance and support in developing and implementing a comprehensive financial plan.

Program Cost and Value Proposition

Online master’s programs in personal finance, while offering flexibility, come with varying price tags. Understanding the average cost and potential return on investment is crucial for prospective students. Factors like program duration, institution prestige, and included services all influence the final price.The financial benefits of a personal finance master’s extend beyond the degree itself. A deeper understanding of investment strategies, budgeting techniques, and debt management can significantly impact personal wealth accumulation and financial security.

The potential for higher earnings and improved financial decisions makes the investment worthwhile for many.

Average Program Costs

The cost of online master’s programs in personal finance varies significantly depending on the institution and program specifics. While some programs are offered at a more affordable rate, others can exceed $30,000. A broad range of pricing models exists, from tuition-based to fully online programs that include other fees. The average cost typically falls within the $15,000-$25,000 range, but this is a rough estimate.

Return on Investment (ROI)

Calculating the ROI of a master’s in personal finance requires considering both direct and indirect benefits. Direct benefits include increased earning potential, while indirect benefits involve improved financial decision-making and reduced financial stress. The ROI is ultimately a personal calculation based on individual circumstances and career goals. Those pursuing careers in finance or looking to enhance their current roles often find a higher ROI than those in other fields.

Potential Financial Benefits

Specialization in personal finance can lead to higher-paying jobs and greater earning potential. Graduates often secure positions in financial advising, wealth management, or related fields. Improved budgeting skills and investment strategies can also contribute to significant savings and increased financial security. For example, understanding investment strategies could lead to substantial returns over time. Improved financial literacy equips individuals to make informed financial decisions, leading to better long-term outcomes.

Financial Aid and Payment Options

Numerous financial aid options are available for online master’s programs, including scholarships, grants, and student loans. Financial aid eligibility criteria vary depending on the program and the applicant’s financial situation.

- Scholarships: Many institutions and organizations offer scholarships specifically for students pursuing master’s degrees in finance. These awards often cover tuition fees or a portion thereof. Application procedures and eligibility criteria vary from program to program.

- Grants: Similar to scholarships, grants can provide financial assistance to students, often without the requirement for repayment. Researching specific grants for finance-related degrees can yield significant financial relief.

- Student Loans: Student loans remain a crucial option for financing higher education. Understanding the interest rates, repayment terms, and eligibility requirements is essential. Comparison shopping between different lenders is important.

Different payment plans and financing options exist for online programs. Some institutions offer installment plans, allowing students to spread tuition costs over multiple semesters. Financing options through private lenders or educational financing companies are also available, offering diverse choices.

Comparing Payment Plans

| Payment Plan | Description | Pros | Cons |

|---|---|---|---|

| Installment Plans | Tuition fees are paid in installments over the program duration. | Provides financial flexibility and reduces the initial burden. | Interest charges may apply, depending on the plan. |

| Student Loans | Loans offered by banks or government agencies for educational expenses. | Potentially large amounts of funding available. | Repayment obligations and interest rates need careful consideration. |

| Private Lenders | Financing options from private educational lenders or financing companies. | May offer tailored options for specific financial situations. | Interest rates and repayment terms may differ significantly. |

Understanding the terms and conditions of each option is critical for making an informed decision. Reviewing the fine print and comparing interest rates and repayment schedules is essential before committing to a specific plan.

Learning Resources and Support

Online master’s programs in personal finance offer a diverse array of learning resources, extending beyond the core curriculum. Students benefit from access to a wealth of materials, expert guidance, and supportive communities that foster deep understanding and practical application. This comprehensive approach significantly enhances the learning experience, enabling participants to gain a competitive edge in the field.A key component of a successful online learning experience is the availability of robust support systems and learning resources.

These systems provide students with the necessary tools and guidance to excel in their studies and effectively apply their knowledge. Online programs often incorporate diverse learning methods to cater to different learning styles and ensure that students receive the support they need.

Learning Resources

Online learning platforms typically provide a range of resources to aid students in their studies. These resources are often meticulously curated and designed to complement the course materials. They frequently include downloadable materials, interactive exercises, supplementary readings, and multimedia content. This comprehensive approach enables students to engage with the material in various ways, enhancing their comprehension and retention.

Support Systems

Effective support systems are crucial for online learners. Many online programs provide tutoring services, offering personalized guidance to students who need extra support. Mentorship programs connect students with experienced professionals in the field, fostering invaluable networking opportunities and providing practical insights. These individualized approaches to learning support can be a significant factor in student success.

Community Engagement

Community engagement plays a vital role in online learning environments. Online forums and discussion boards provide a platform for students to interact with peers and instructors, sharing experiences, asking questions, and collaborating on projects. This collaborative environment fosters a sense of belonging and encourages knowledge sharing, which is invaluable for skill development and practical application.

Online Forums and Discussion Boards

Active online forums and discussion boards are essential for facilitating community engagement. These platforms provide a structured space for students to engage in discussions, ask questions, and receive feedback from instructors and peers. Students can share insights, explore different perspectives, and learn from each other’s experiences. This collaborative environment significantly enhances the learning process.

Online Tools and Platforms

Numerous online tools and platforms can significantly enhance the online learning experience. Financial calculators, budgeting templates, and investment simulators are frequently integrated into the curriculum. These tools enable students to apply their knowledge in a practical setting, fostering a deeper understanding of the concepts. Furthermore, access to online libraries and databases allows students to delve deeper into specific areas of interest, enriching their overall learning journey.

Summary

In conclusion, pursuing an online master’s in personal finance for beginners offers a valuable pathway to financial literacy and career advancement. The programs provide a structured curriculum, practical application, and support systems to ensure success. By understanding the key characteristics of reputable programs, the curriculum’s content, and the practical application of knowledge, individuals can confidently embark on this educational journey.

The potential for career advancement and financial empowerment makes this a worthwhile investment for anyone seeking to master their personal finances.