International students seeking advanced degrees in financial planning face a complex landscape of program options. Navigating diverse specializations, accreditation standards, and financial aid opportunities can be challenging. This comprehensive guide dissects the key factors for international students considering a master’s in financial planning, highlighting top programs, curriculum details, and career prospects.

From wealth management and investment analysis to financial risk management, the field offers specialized tracks. Understanding the curriculum structure, program accreditation, and the specific visa requirements for international students is crucial. This analysis will help international students make informed decisions about their educational pursuits and career paths.

Introduction to Master’s Programs in Financial Planning

Master’s programs in financial planning are designed to equip graduates with advanced knowledge and skills in managing financial resources. These programs cater to aspiring financial advisors, investment analysts, and wealth managers, providing in-depth understanding of various financial instruments and strategies. The programs go beyond introductory financial concepts, delving into complex topics such as portfolio management, risk assessment, and financial modeling.These specialized programs allow students to focus on specific areas of financial planning, leading to distinct career paths.

Graduates are prepared for a range of roles, from advising high-net-worth individuals to managing investments for institutional clients. Understanding the diverse specializations and curriculum structure is crucial for international students seeking to pursue these programs.

Overview of Specializations

Master’s programs in financial planning often offer various specializations, each with its own curriculum and career prospects. Key areas of specialization include wealth management, investment analysis, financial risk management, and financial modeling. Students can tailor their learning to align with their career aspirations and expertise.

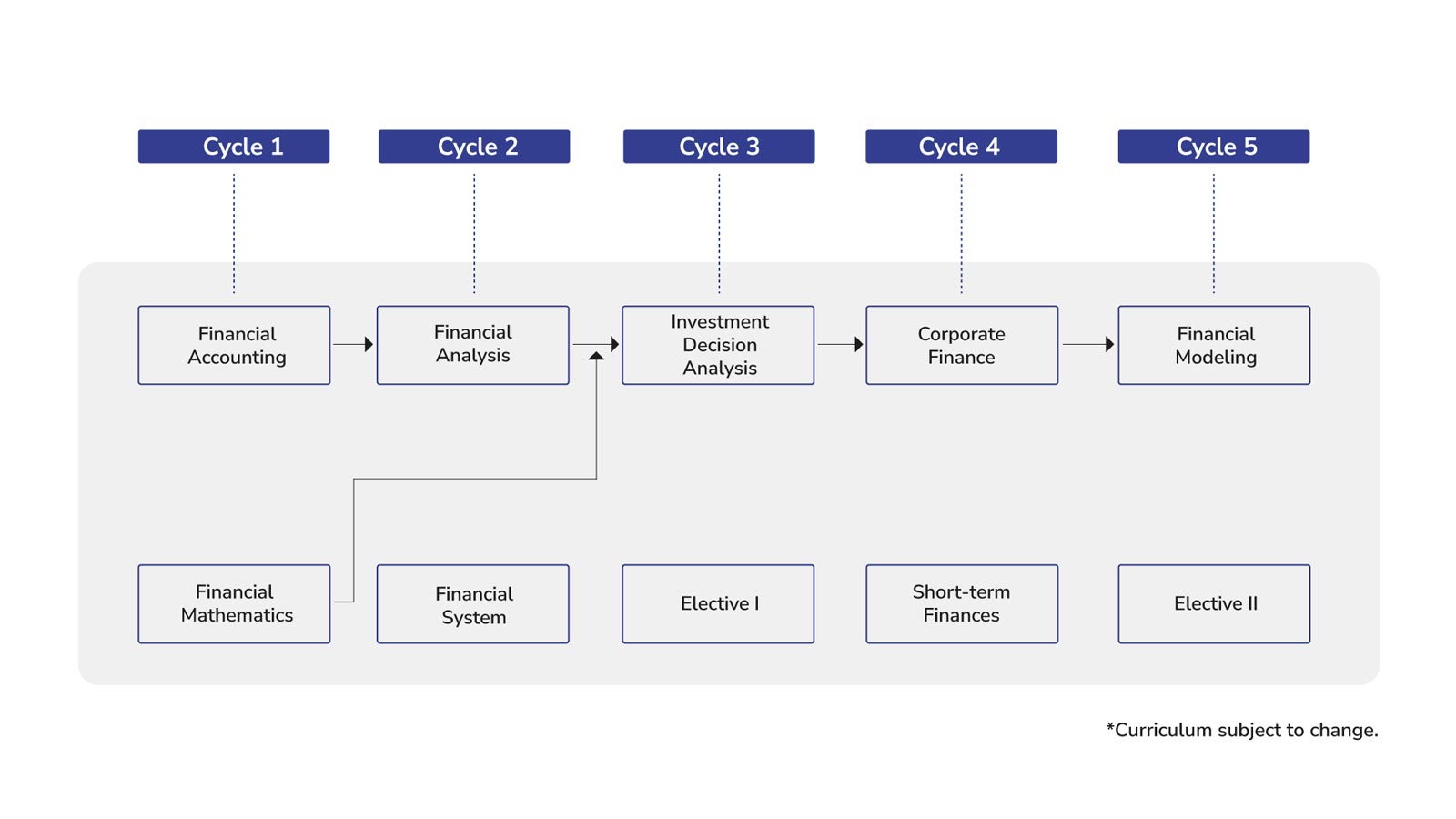

Curriculum Structure

The typical curriculum for a Master’s program in financial planning comprises core courses in financial principles, investment strategies, and financial markets. These foundational courses provide a solid base for advanced study in specialized areas. Elective courses allow students to delve deeper into their chosen area of specialization. Students also often participate in practical projects, internships, and case studies to apply their knowledge and hone their skills.

Comparison of Specializations

| Specialization | Key Courses | Career Prospects |

|---|---|---|

| Wealth Management | Advanced Investment Strategies, Estate Planning, Philanthropy, High-Net-Worth Client Management | Financial Advisor, Private Banker, Wealth Manager, Family Office Administrator |

| Investment Analysis | Portfolio Management, Security Analysis, Financial Modeling, Quantitative Analysis | Investment Analyst, Portfolio Manager, Equity Research Analyst, Hedge Fund Analyst |

| Financial Risk Management | Risk Assessment, Derivatives, Credit Risk, Market Risk, Operational Risk, Stress Testing | Risk Manager, Financial Analyst, Actuary, Compliance Officer |

| Financial Modeling | Financial Statement Analysis, Valuation Techniques, Forecasting, Simulation Modeling, Data Analysis | Financial Analyst, Investment Banker, Business Analyst, Financial Consultant |

The table above provides a concise comparison of the key courses and career paths associated with each specialization. A robust understanding of the courses and associated careers allows students to choose the program that best suits their goals and preferences.

International Student Considerations

International students seeking a Master’s in Financial Planning face unique challenges and opportunities. Navigating different educational systems, visa requirements, and financial aid options necessitates careful consideration. This section details crucial factors for international students to assess when choosing a program. Successful completion and future career prospects depend on understanding these factors thoroughly.

Program Accreditation and Global Recognition

Program accreditation is paramount for international students. A globally recognized accreditation assures the quality and rigor of the program’s curriculum. This validation often influences potential employers’ perceptions of the degree’s value and standing in the international financial planning community. Reputable accrediting bodies, like the relevant financial planning organizations in different regions, signify a program’s adherence to industry standards and best practices.

Recognition by international financial institutions or regulatory bodies further enhances the value of the degree for prospective graduates.

Financial Aid Options and Scholarships

International students often require financial support to pursue their studies abroad. Many institutions offer scholarships and financial aid packages specifically designed for international students. These often consider academic merit, financial need, and specific program goals. Prospective students should thoroughly research the financial aid and scholarship opportunities available at the chosen institution. Additionally, exploring government-funded student loan programs or private scholarship organizations tailored to international students can broaden their funding options.

Visa Requirements and Application Procedures

Obtaining the correct visa is critical for international students to legally study in a foreign country. Visa requirements and application procedures vary significantly by country. Thorough understanding of these requirements is essential for a smooth transition. The process can be complex, and international students should consult official government websites and the institution’s international student services office for specific guidelines.

| Country | Visa Requirements | Application Procedures |

|---|---|---|

| United States | F-1 visa, often requiring proof of financial resources and academic records. Specific documentation requirements and processing times vary by applicant. | Application submitted through the Student and Exchange Visitor Program (SEVP) portal, followed by a visa interview at a US embassy or consulate. International students should anticipate a processing time frame. |

| United Kingdom | Tier 4 student visa, requiring proof of financial support and English language proficiency. Details vary by specific program and course. | Application through the UK Visas and Immigration website. International students must adhere to specific deadlines and submit necessary documentation, often including financial statements and proof of enrollment. |

| Canada | Study permit, often requiring evidence of financial support, proof of enrollment, and language proficiency tests. | Application through the IRCC (Immigration, Refugees and Citizenship Canada) website. International students must follow the specific guidelines and deadlines for their chosen program and country. |

Top Programs and Universities

Global demand for skilled financial planners is surging, driving a need for robust and rigorous Master’s programs. Recognizing this, prestigious universities worldwide are offering specialized financial planning programs, each with unique strengths. This analysis examines leading institutions, their program features, and the criteria used for selection, providing valuable insights for international students seeking advanced financial knowledge.Selecting a Master’s in Financial Planning requires careful consideration of factors like curriculum, faculty expertise, and research opportunities.

A strong program typically blends theoretical knowledge with practical application, preparing graduates for the challenges of the financial industry. The ranking methodology used for this selection process considers academic reputation, faculty qualifications, research output, and industry partnerships.

Reputable Universities and Program Strengths

This section details several top-tier universities offering exceptional Master’s in Financial Planning programs. These institutions are recognized for their commitment to quality education and industry relevance.

- University of Pennsylvania, Wharton School: Renowned for its rigorous curriculum and strong faculty network, Wharton’s Master’s program in Financial Planning boasts extensive industry connections. Its emphasis on quantitative analysis and practical application sets it apart. However, the program’s high tuition fees might pose a challenge for international students. Wharton’s research initiatives often focus on cutting-edge financial modeling and market analysis. The faculty comprises prominent academics and industry leaders, providing students with invaluable insights and real-world experience.

- London School of Economics and Political Science (LSE): The LSE offers a globally recognized Master’s program that emphasizes both theoretical and practical aspects of financial planning. The program attracts students from diverse backgrounds and focuses on developing analytical skills. While the program excels in theoretical knowledge, it might lack the extensive industry connections compared to programs at other universities. Research opportunities are plentiful and often involve collaborations with leading financial institutions.

- Massachusetts Institute of Technology (MIT): MIT’s program, emphasizing quantitative finance and financial engineering, provides students with strong analytical tools. The rigorous curriculum, demanding high academic standards, might not be suitable for every candidate. MIT’s research opportunities are unparalleled, with access to cutting-edge technologies and datasets for in-depth study. Faculty expertise leans towards technical aspects of finance, giving students a competitive edge in quantitative analysis.

When investigating detailed guidance, check out best master’s in financial planning programs for career changers now.

- University of Chicago Booth School of Business: Booth’s Master’s program in Financial Planning emphasizes a rigorous academic approach, integrating both theoretical frameworks and practical applications. The program benefits from a strong reputation in finance and a renowned faculty. However, the program’s highly selective admission process could pose a challenge. The program’s research focus often centers on behavioral finance and empirical studies of market trends.

- Columbia University, Business School: Columbia’s program combines a strong academic reputation with a diverse range of financial planning specializations. The faculty is a blend of experienced academics and industry practitioners, giving students valuable insight into real-world applications. The program excels in providing a comprehensive understanding of various financial planning approaches. However, the rigorous curriculum might be demanding for some students. Research opportunities are diverse, often involving collaborations with leading financial institutions and government agencies.

Ranking Methodology

The selection of these top programs was based on a multi-faceted approach. The methodology includes:

- Academic Reputation: The university’s overall academic standing, as assessed by reputable ranking organizations, is a crucial factor. Prestige often reflects a strong faculty, robust research, and successful alumni networks.

- Faculty Expertise: The qualifications and experience of the faculty members are considered, evaluating their academic achievements, publications, and industry experience. This is a critical element for quality instruction and research guidance.

- Research Opportunities: The program’s emphasis on research and the availability of research opportunities are evaluated. These opportunities allow students to contribute to the field and develop valuable research skills.

- Industry Partnerships: The program’s collaborations with industry partners are examined. These partnerships often provide valuable internships, networking opportunities, and industry insights.

Top 5 Programs Overview

| Program Name | Location | Estimated Tuition Fees (USD) | Average Student Profile |

|---|---|---|---|

| Wharton Master’s in Financial Planning | Philadelphia, USA | $70,000 – $80,000 | High-achieving undergraduate students with strong quantitative backgrounds and financial interests. |

| LSE Master’s in Financial Planning | London, UK | $40,000 – $50,000 | International students with diverse academic backgrounds and a passion for finance. |

| MIT Master’s in Financial Engineering | Cambridge, USA | $65,000 – $75,000 | Highly analytical students with a strong mathematical and computational background. |

| Booth Master’s in Financial Planning | Chicago, USA | $60,000 – $70,000 | Students with a strong background in finance, business, or economics. |

| Columbia Master’s in Financial Planning | New York, USA | $55,000 – $65,000 | Students with a broad understanding of finance and business, looking for a diverse educational experience. |

Career Prospects and Job Market

The global financial planning industry is experiencing robust growth, creating numerous opportunities for skilled professionals. International graduates with master’s degrees in financial planning are well-positioned to capitalize on this trend, provided they possess the necessary skills and understand the specific market nuances of their target countries. Competition for these positions is often keen, but those with specialized knowledge and demonstrable expertise are in high demand.The job market for financial planners is dynamic and evolving, driven by changing economic landscapes, technological advancements, and shifting client needs.

International graduates must adapt to these changes by focusing on practical skills, staying updated on industry trends, and building strong professional networks. This necessitates a comprehensive understanding of local regulations and cultural sensitivities within their target countries.

Job Market Outlook for International Graduates

The job market for financial planners, particularly for international graduates, shows positive growth potential. Many countries are experiencing an aging population, increasing wealth, and a rising demand for financial advice. This trend presents lucrative opportunities for those with the necessary expertise and a willingness to adapt to the local market. While the specific requirements and regulations vary significantly across countries, financial planners with a solid foundation in financial planning principles and a thorough understanding of the local regulatory landscape are highly sought after.

Potential Career Paths and Entry-Level Roles

Graduates can pursue a variety of career paths, including roles in wealth management, investment advisory, retirement planning, estate planning, and insurance brokerage. Entry-level positions may involve assisting senior financial planners with client interactions, conducting research on investment opportunities, or preparing financial statements. These roles often require strong analytical skills, communication abilities, and a keen interest in financial markets.

Salary Expectations and Potential for Advancement

Salary expectations for financial planners vary significantly depending on factors such as experience, specialization, location, and employer. In many developed economies, entry-level roles can offer competitive salaries, while senior-level positions can command substantial compensation packages. The potential for advancement within the financial planning industry is generally high, with opportunities for career progression into senior management, leadership positions, or specialized niches like tax planning or international finance.

Potential Career Paths After Graduation

| Career Path | Required Skills | Expected Salary (USD, approximate) |

|---|---|---|

| Wealth Management Associate | Strong analytical skills, financial modeling proficiency, excellent communication skills, knowledge of investment products | 50,000 – 80,000 |

| Investment Advisor | Thorough understanding of financial markets, investment strategies, portfolio management, client relationship management | 60,000 – 120,000+ |

| Retirement Planner | Expertise in retirement planning strategies, pension analysis, and financial projections, client counseling skills | 65,000 – 100,000+ |

| Estate Planner | Knowledge of estate law, tax implications, wealth transfer strategies, client communication | 70,000 – 150,000+ |

| Insurance Broker | Understanding of insurance products, risk management, client needs analysis, sales techniques | 55,000 – 90,000 |

Note: Salary ranges are approximate and can vary based on experience, location, and employer.

Program Application Process and Requirements

Securing a coveted Master’s in Financial Planning requires a meticulous application process. International students, in particular, must navigate specific requirements and deadlines. This section details the steps involved, essential documents, and strategies for a successful application.The application process for Master’s in Financial Planning programs generally follows a standardized format, though specifics vary between institutions. Applicants typically need to submit a comprehensive application package, encompassing academic records, letters of recommendation, standardized test scores (if required), and a personal statement.

Careful attention to detail and adherence to program-specific instructions are crucial for a smooth and successful application.

Application Procedure Overview

The application procedure involves multiple stages, each with specific tasks and deadlines. Applicants must meticulously gather required documents, complete online application forms, and submit all requested materials before the application deadline. Thorough preparation and organization are key to navigating the process effectively.

Required Documents

A successful application necessitates a comprehensive package of documents. Essential components include academic transcripts, official proof of English language proficiency (if applicable), letters of recommendation, a personal statement, and financial documentation. Standardized test scores (such as GRE or GMAT) may also be required, depending on the program.

- Transcripts: Official transcripts from all previously attended institutions are typically required. These documents verify academic history and demonstrate the applicant’s qualifications. Transcripts should be submitted in their original language and translated, if necessary, into the language of instruction for the program.

- Letters of Recommendation: Letters of recommendation serve as testimonials from professors, supervisors, or employers who can attest to the applicant’s skills, character, and potential for success in the program. Applicants should identify individuals who can provide insightful assessments of their abilities and provide specific examples to support their recommendations.

- Standardized Test Scores: Some programs may require standardized test scores such as GRE or GMAT. These tests assess analytical and quantitative skills, often considered crucial for success in a financial planning program. Applicants should consult program-specific requirements to determine if these tests are necessary.

- Statement of Purpose/Personal Statement: This statement allows applicants to articulate their motivations for pursuing the Master’s degree in Financial Planning. It provides an opportunity to showcase their interests, career aspirations, and how the program aligns with their long-term goals. A compelling statement should highlight relevant experiences and demonstrate a clear understanding of the program’s objectives.

- English Language Proficiency: If the program’s language of instruction is English, applicants from non-English speaking countries often need to demonstrate their proficiency through standardized tests like TOEFL or IELTS. Specific requirements for test scores vary between programs.

Crafting a Strong Application

A compelling application goes beyond simply meeting the minimum requirements. It showcases the applicant’s unique strengths, motivations, and potential for success. Highlighting relevant work experience, volunteer activities, or personal projects that demonstrate financial acumen or leadership qualities can significantly strengthen an application. A clear understanding of the program’s curriculum and faculty can further solidify the application’s impact.

Application Deadlines and Requirements

The following table Artikels application deadlines and required documents for select Master’s in Financial Planning programs. Note that these are examples and specific requirements may vary.

| Program | University | Application Deadline | Required Documents |

|---|---|---|---|

| Master of Financial Planning | University of X | October 31, 2024 | Transcripts, Letters of Recommendation, Statement of Purpose, English Proficiency Test (if applicable) |

| Master of Financial Analysis | University of Y | December 15, 2024 | Transcripts, Letters of Recommendation, GMAT Score, Resume, Portfolio (if applicable) |

| Master of Investment Management | University of Z | January 15, 2025 | Transcripts, Letters of Recommendation, TOEFL Score, Statement of Purpose, Financial Statement |

Illustrative Examples of Program Descriptions

Master’s programs in financial planning offer specialized knowledge and skills for aspiring professionals. Understanding the diverse offerings across institutions is crucial for international students navigating their educational choices. These detailed program descriptions highlight key aspects, learning outcomes, and faculty, providing a clearer picture of the educational experience.Program descriptions below showcase the range of specializations within financial planning, emphasizing the value proposition of each program and their suitability for international students.

Each program’s mission and vision underscore its unique contribution to the field.

Master of Science in Financial Analysis

This program equips students with a comprehensive understanding of financial markets, investment strategies, and risk management. The curriculum delves into quantitative analysis, portfolio construction, and financial modeling.

“Our mission is to cultivate future financial analysts capable of driving informed decision-making in the dynamic global marketplace.”

Key Learning Outcomes:

- Proficient in using financial modeling software like Bloomberg and Excel.

- Develop advanced knowledge in asset pricing and portfolio management.

- Analyze financial statements and interpret market trends.

Key Faculty:

- Dr. Anya Sharma, renowned expert in derivatives pricing and risk management.

- Professor David Lee, specializing in portfolio optimization and algorithmic trading.

Master of Financial Planning and Wealth Management

This program provides a holistic approach to financial planning, covering personal finance, retirement planning, estate planning, and investment strategies. It fosters a deep understanding of client needs and financial advisory best practices.

“Our vision is to empower individuals and families to achieve their financial goals through strategic planning and sound investment advice.”

Program Highlights:

- Comprehensive coverage of estate planning and tax optimization.

- Focus on client relationship management and communication skills.

- Practical experience through case studies and internships.

Key Faculty:

- Dr. Emily Chen, specializing in retirement planning and financial literacy.

- Professor Michael Rodriguez, experienced in wealth management and investment strategies.

Master of Financial Technology (FinTech)

This program combines financial planning with technological innovation, focusing on the intersection of finance and technology. Students develop expertise in fintech applications, blockchain technology, and digital asset management.

“Our goal is to prepare graduates to leverage technology to create innovative financial solutions for the future.”

Key Learning Outcomes:

- Understand blockchain technology and its implications for finance.

- Develop proficiency in programming languages relevant to financial applications.

- Design and implement financial products using fintech platforms.

Key Faculty:

- Dr. Benjamin Kim, pioneer in the application of artificial intelligence to financial markets.

- Professor Sarah Park, leading expert in digital asset management and cryptocurrency regulation.

Last Recap

In conclusion, securing a Master’s in Financial Planning as an international student requires careful consideration of program specializations, accreditation, and financial aid. Top programs offer specialized curricula, faculty expertise, and research opportunities, leading to promising career prospects. Thorough research, understanding of application procedures, and strategic planning are crucial to success. This guide provides the essential information for navigating this process.